- A look at Royal Mail Share Price for 2022, 2025 and 2030 plus its recent financial reports and recent headlines.

In this article, we will look at Royal Mail Share Price prediction for 2022, 2025, and 2030. We will also go through its recent financial reports and recent headlines that are likely to impact the company’s growth.

Royal Mail Profile

Royal Mail has a rich history of over 500 years. The company was founded in 1516, and for 499 years, it remained under the ownership of the UK government. However, in 2013, the company was floated to the London Stock Exchange, allowing the public to invest in it. It also marked the end of the UK government’s control of the company.

Today, the Royal Mail remains one of the most popular parcel delivery companies for UK customers. The service is used by 37 of the top 100 online retail stores in the UK. The company consists of two principal operations, its UK-based Royal Mail and Parcelforce Worldwide (Royal Mail) and its international logistics operation General Logistics Systems (GLS). At its core, the company offers mail and parcel delivery services mainly for UK citizens.

Royal Mail Financial Reports

Royal Mail had a strong 2021 financial report. The company reported a net profits of 620 million British pounds (GBP) This was a 285.09 percent increase in income compared to 2020 when the company generated profits worth £161 million. Its year-on-year revenue growth was also 16.59 percent from £10.84 billion to £12.64 Billion in 2021.

In 2021, Royal Mail PLC failed to generate a significant amount of cash. However, the company still managed to make £1.17 billion from its operations. This represented a cash flow increase of 9.28 percent for the year. The financial reports also show that the company managed to invest £286 million and paid £944 million in financing cash flows.

Royal Mail Fundamental Analysis

The recent news cycle is not looking great for Royal Mail. This includes the recent decision by the UK government to remove all covid-19 restrictions. Although in general, this is a good thing, it will negatively impact Royal Mail. This is because, for most of 2020, 2021, and the early months of 2022, most people turned to Royal Mail for their deliveries due to lockdowns. Online retail companies also saw their sales increase. These retail companies would in turn use the services offered by Royal Mail for their package deliveries. However, with the restrictions lifted, chances are that many people will start going to the malls and supermarkets, hence, Royal Mail’s profits are likely to drop.

Another news cycle item that has made Royal Mail outlook look negative is the increasing in competition in the mail and package delivery sector. Since the pandemic began, many well-funded startups have emerged in the UK that promise much faster deliveries. This has resulted in some of these companies taking a huge chunk of what was traditionally a Royal Mail service market. Although the competition has not resulted in a drop in the number of deliveries made by Royal Mail, the company’s market share has been eaten by these new startups.

Royal Mail Share Price 2022

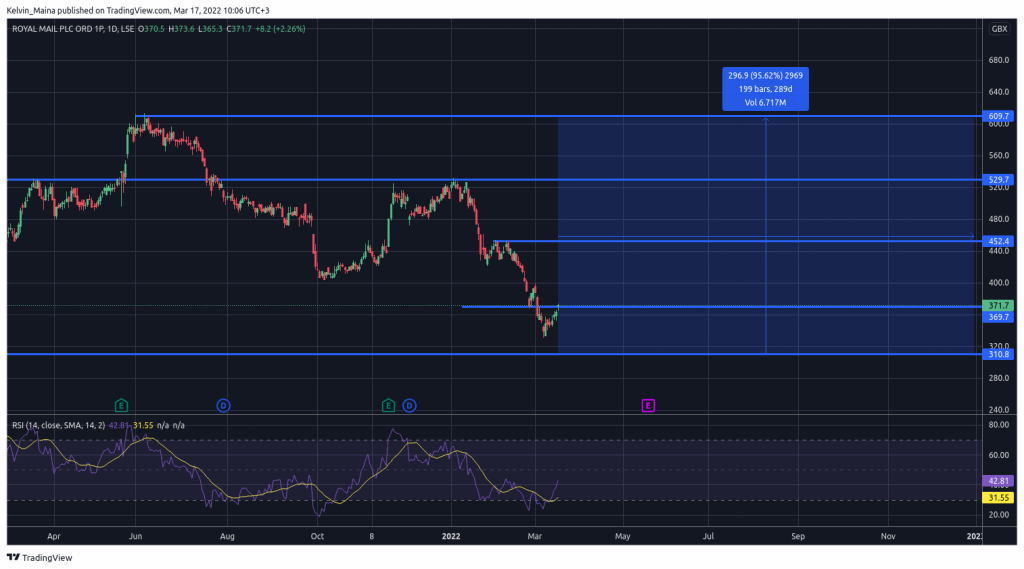

In 2022, Royal Mail’s share price has already lost 30 percent of its value. Today, the company’s shares are trading at 371 GBp. Looking at the daily chart below, the prices have also broken the long-term support level at 369 GBp but failed to continue the bearish move. The prices have since retreated back inside the 369p and 452p support and resistance levels, which is why I expect the Royal Mail share price to trade at 609 GBp by the end of 2022.

My analysis is based on a number of factors including the past price action volatility that has proved that the share prices have the potential to become very bullish. This has included recent bullish rallies such as the October 13, 2021 rally that saw the Royal Mail share price rise by 30 percent in less than two months. I also expect the share prices to trade within the blue area as shown in the chart below between now and the end of the year. Therefore, my expected return on investment based on today’s prices is 63 percent.

Royal Mail Share Price Daily Chart

Royal Mail Share Price 2025

My Royal Mail share price prediction for 2025 expects the prices to trade between 609 GBp and 800 GBp. This is a very conservative return on investment for the share prices. However, it is a very realistic expectation for the share price. This is because, by 2025, I expect the mail and parcel delivery business to have changed dramatically. The company will have more competition than it has now, and with the advent of online retailers adopting their own mailing service, the company’s market will have reduced.

Royal Mail Share Price 2030

My Royal Mail share price prediction for 2030 expects the prices to trade between 350 GBp to 650 GBp. This is because, between 2025 and 2030, I do not expect the company to grow. This is because of increased competition, and the likelihood that most services it offers today will have been phased out by technology. My prediction is also based on its price history, where the prices have never traded above GBp 700 in the past. There is a high likelihood that the share prices will have entered a long-term bearish move by 2030.