Rolls-Royce share prices have been on a slump since November 10, 2021. This has seen the company lose almost 40 per cent of its value during that time. Rolls-Royce fundamentals have been both positive and negative in the past few weeks. This includes the news of Chief Warren East leaving the company. The announcement resulted in the prices of Rolls-Royce shares tumbling 18 per cent at some point. The announcement also was badly timed and collided with the muted guidance for the coming year, which put investors of the company at unease.

The invasion of Ukraine also resulted in the company pulling out of the Russian market. The company also announced the halting of all businesses in Russia. Although this announcement did not seem to move its share prices, the decision is likely to see a reduction in revenue. It is also likely to see the company losing the Russian market forever in the coming years.

However, those are not the only news that affected the company in the past few weeks. Positive news such as investment of £500m from France, the US and Qatar. In the long-term, this investment is likely to see the Rolls-Royce share price start to gain in the markets, which will be a huge boost from the current slump in prices.

Rolls-Royce Share Price Prediction

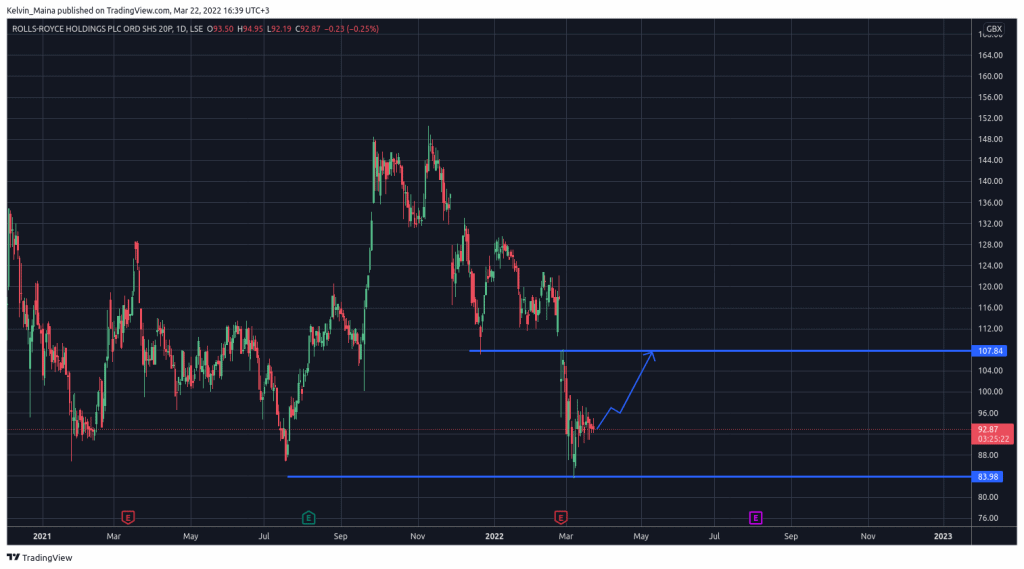

For the entire month of March, Rolls-Royce’s share prices have struggled to make any significant movement. The share prices have traded sideways with each day showing a loss of momentum and volatility of the stock prices. However, even with low volatility in the Rolls-Royce market, there is a possibility that the prices are setting up for a big bullish move.

If that happens, then I expect the prices of Rolls-Royce to trade at GBp 107 in the coming days. This is a long-term resistance level. There is also a high likelihood that the prices may go past the resistance level. However, investing in Rolls-Royce expecting a bullish move is still risky. This is because, for a market that is trading sideways, there is a chance that the next move may be bearish.

Rolls-Royce Daily Chart