- Rio Tinto share price has continually overperformed in the markets throughout the year, and is among the few that are still bullish in 2022.

Throughout the year, commodity prices have been rising, which has greatly benefitted Rio Tinto and has seen its prices continue to grow. However, in the past month, Rio Tinto has entered an aggressive bearish market that has resulted in the company losing 14 per cent of its value and almost wiping out the year-to-date gains, which currently stand at only a percentage point.

Why Rio Tinto has Outperformed the Markets

In a report released by the World Bank in April, metal prices were projected to increase by 16 per cent in 2022 before easing in 2023. The current sanctions imposed on Russia, one of the largest mining countries in the world, is also likely to see the prices of commodities continue to rise throughout the year and possibly outperform the World Bank’s projection.

The rise in commodities has allowed Rio Tinto to perform well in the current bear market that has seen almost all stocks aggressively losing in the markets. Rio Tinto, one of the world’s largest mining companies, with interests in countries such as Australia, South Africa, Canada, Madagascar, and Iceland, has seen its demand for minerals increase with the increasing prices. The company deals with top-demand commodities such as lithium, aluminium, copper, and iron ore, which are currently performing well in the markets.

Rio Tinto Share Price Analysis

Rio Tinto’s share price going into the future will be greatly impacted by fundamental factors such as when the war in Ukraine will end and if sanctions will be lifted on Russian companies that are some of the company’s biggest competitors.

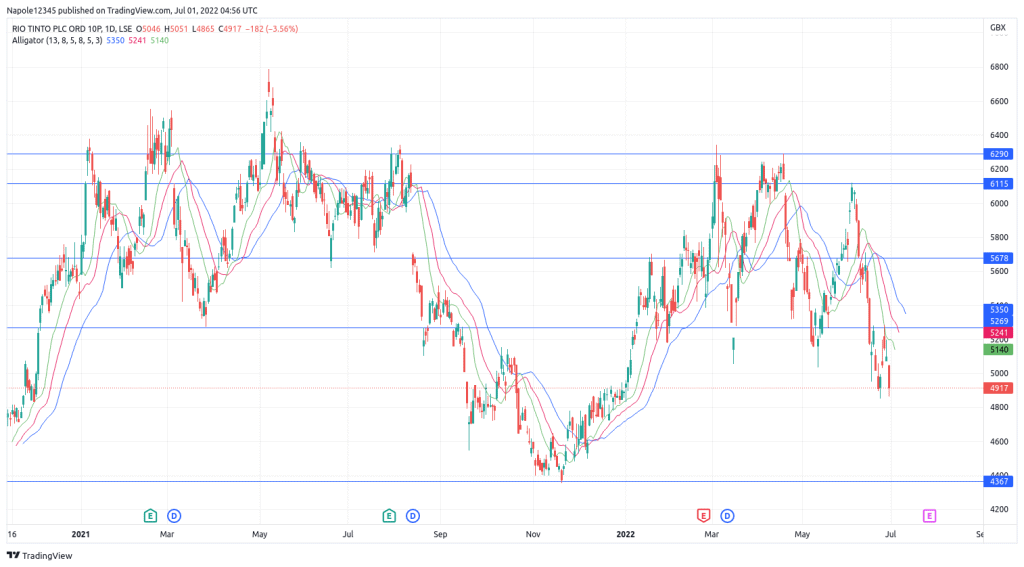

Therefore, despite being down in the past month by 14 per cent, my Rio Tinto share price analysis is still bullish going into the next few trading sessions. I also expect the company to be bullish in the year’s second half. There is a high likelihood that, in the short term, we will see prices trading above 5,500p. On the flip side, the current drop in price may offer investors an opportunity to buy Rio Tinto shares at a discount.

Rio Tinto Daily Chart