- The Procter & Gamble share price could dip in today's trading, but a dip presents buying opportunities if the 12-month price target is valid.

The Procter & Gamble share price looks set for a lower open this Monday, as it trades at 140.56 in premarket trading. This is lower than the 141.95 market price the stock closed with on Friday.

The stock may be printing lower, but twenty-three institutional analysts are bullish on the stock and have indicated a potential for the Procter & Gamble share price to hit an average of 165.15. There is a high and low price band, though, with 185 and 124 serving as the price extremes of the forecasts.

On Friday, 10 June, the stock had a modest bullish response to the announcement of a new digital manufacturing partnership between it and Microsoft. The two companies will work to expand Procter & Gamble’s manufacturing platform, enhancing its scalability and predictive quality for manufacturing optimization. This will be the first of such agreements to co-innovate and leverage predictive data to make the manufacturing process more customer-centric at cheaper costs.

Technically speaking, the downside premarket move follows the inability of the bulls to close Friday’s down gap. As a result, we could see a straight push to the next support or a potential return move that tests the pattern’s neckline in a role reversed function.

Procter & Gamble Share Price Forecast

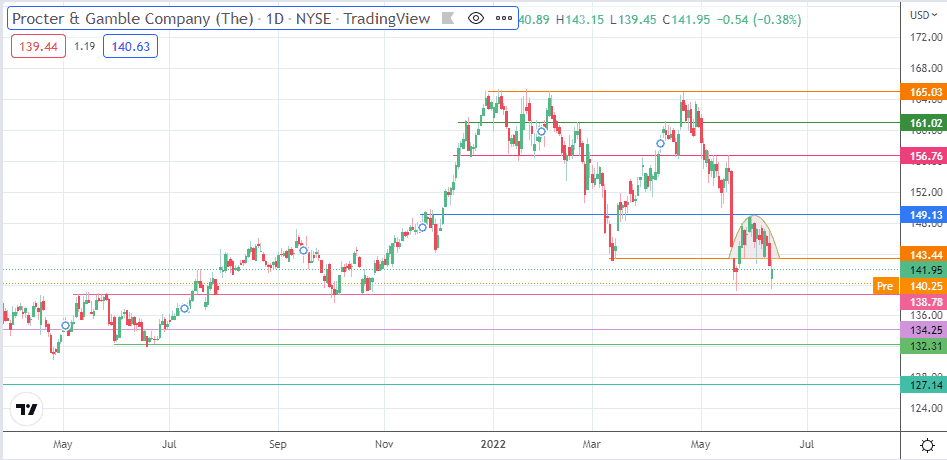

The rounded top pattern on the daily chart resolved with a downside break on Friday. Today’s downside gap completed the pattern after bouncing off the 140.00 psychological support. The price action is now returning to the broken neckline at 143.44. A rejection at that support-turned-resistance point allows for a renewed push towards the 138.78 price support (28 July 2021 and 20 October 2021 lows).

Additional support below this level is seen at 134.25 (29 June 2021 low) and 132.21 price marks (23 June 2021 low). Conversely, a break of the pattern’s neckline to the upside by the return move sends the price action toward the 149.13 resistance (22 November 2021 and 27 May 2022 highs).

Above this level, the 152.00 psychological price mark (6 December 2021 and 16 March 2022 highs) forms an additional resistance. 156.76 (17 May high) and 161.02 (22 February and 11 April highs) are potential barriers to the north that become viable if 152.00 gives way.

PG: Daily Chart