- PEPE Coin price hit the second all-time-highs in as many days, to become the third-largest meme coin by market cap, but the upside is limited

PEPE coin price spiked to new all-time highs on Wednesday, registering an intraday high of $0.0000143, before declining by 2.20 percent to trade at $0.0000135 at the time of writing. This is the second consecutive day that the coin has registering an ATH building from Tuesday’s single-day surge of 21.12 percent.

PEPE’s gains reflect its native ecosystem coin, Ethereum’s rally, which has seen the second most valuable crypto asset rise by more 20 percent in the last two trading sessions. As of this writing, PEPE’s 24-hour traded volume is up by 76 percent, signaling a potential continuation of the strong market momentum. Furthermore, its market capitalization has risen to $5.6 billion, making it the third-most valuable meme token after Dogecoin and Shiba Inu, as per cryupto analytics site, CoinMarketCap.

Ethereum is riding on the positive momentum surrounding speculation of a possible ETH ETF approval in the United States. The SEC has until May 23 to relay its ETF application decision , and the announcement is likely to inject a fresh volatility into Ethereum and its associated tokens like PEPE. However, on the flipside, there’s a risk that the momentum could cool off and a reversal initiated if the application gets rejected.

Furthermore, it is likely that the market sentiment could normalize even if the ETF gets approved, leading to profit-taking. However, meme coins have proven to be exceptions to the rule in recent weeks by rising while the rest of the crypto market was in a downturn. Therefore, Ethereum’s decline may not necessarily drag down PEPE.

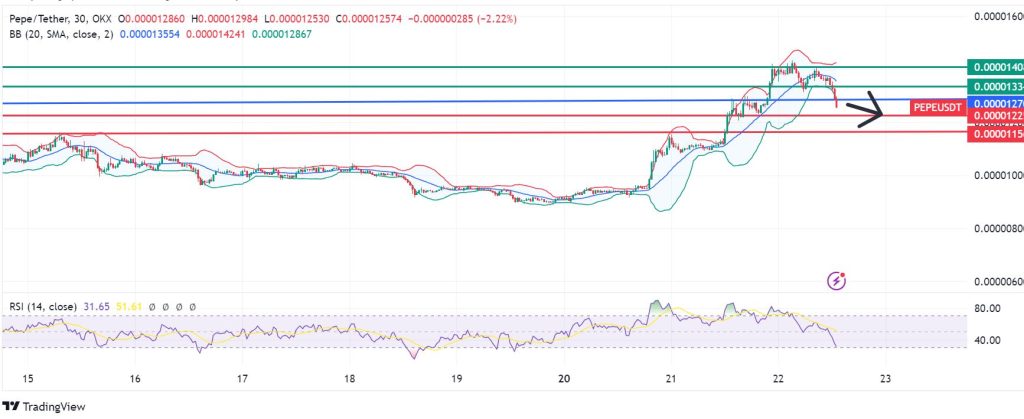

Technical analysis

The momentum om PEPE coin will likely favour control by the sellers if resistance persists at $0.0000127. That could break the support at $0.0000122, and propel further downward movement to test $0.0000115 in extension. Otherwise, a move above $0.0000127 could shift control, to the buyers, with the next resistance likely to be at $0.0000133. A break above that level will not only invalidate the downside narrative, but also potentially build the momentum to move further up to test $0.0000140.