- The Nvidia stock price has rebounded in the past few days after finding a strong support at its 52-week low.

The Nvidia share price has rebounded in the past few days after finding a strong support at its 52-week low. The NVDA stock is trading at $244, which is higher than the year-to-date low of $205. It is still about 28% below the highest level this year.

Nvidia stock has been one of the best performers in the past few months, which has propelled it to become the biggest chip company in the world. It has become bigger than Intel and AMD combined as demand for GPUs has risen. As a result, the company’s total revenue has jumped from over $9.7 billion in 2018 to over $26 billion in 2021. In the same period, the company’s net income has risen to more than $9.7 billion, making it one of the most profitable companies in the industry.

Nvidia has benefited from the overall growth of several important industries like gaming, metaverse, cloud computing, and artificial intelligence. For example, its GPUs have become the default of most data centers and Bitcoin mining companies.

However, there have been concerns about whether the company will maintain this growth in the coming years. In a recent statement, analysts at Bank of America noted that the company will be a key beneficiary considering that the GPU market was still early in its upgrade cycle. They expect that the share price will retest its all-time high soon.

A key concern among investors is that the Nvidia stock price is significantly overvalued considering that it is trading at a forward PE multiple of 51.26. In contrast, companies like Taiwan Semiconductor, Broadcom, and Intel have a forward multiple of below 30. Proponents argue that the company’s growth and market share will support the pricey valuation as interest rates rise.

Nvidia share price analysis

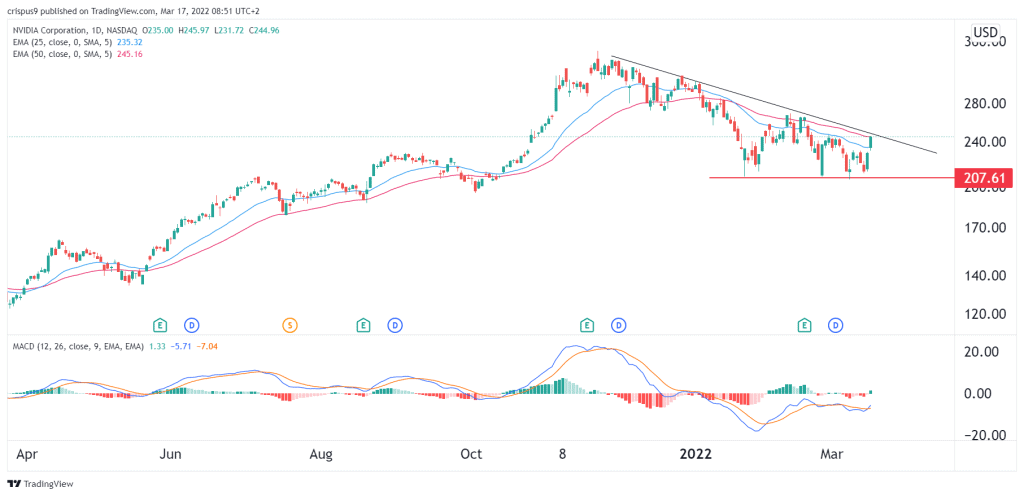

Turning to the daily chart, we see that the NVDA stock price found a strong support at $207. It has struggled to move below this level since January this year. At the same time, the stock seems like it has formed a descending triangle pattern. In price action analysis, a descending triangle is usually a bearish signal. Therefore, there is a likelihood that the Nvidia share price will have a bearish breakdown in the coming weeks. This view will be confirmed if the shares manage to move below the support level at $207. If this happens, the next key support level to watch will be at $150.