- The Nvidia share price could be in for a further advance if the resistance at $180 is cleared by the bulls.

The Nvidia share price ended Thursday’s trading session slightly higher ahead of the US House of Representatives vote on a bill to boost the domestic semiconductor manufacturing industry. This vote comes after the US Senate passed a bill by a majority vote to provide $280 billion in funding to the struggling US semiconductor sector, following a year of struggles with shortages and reduced production capacity caused by the COVID-19 pandemic.

The Nvidia share price continues to carry high valuations, given the recovery in the personal consumption expenditure space, ex. food and energy for the domestic market. Nvidia is rumoured to be on the verge of releasing its GeForce RTX 40 series GPU, which could give the company a revenue boost.

While supply chain constraints have not eased and continue to constitute a headwind to the recovery of chip supply to pre-pandemic levels, Nvidia could mitigate this via price increases which its top-level customers could absorb.

The Nvidia share price’s major fundamental trigger comes in the form of earnings on 24 August 2022. The market projections see Nvidia notching EPS of $1.25 per share, higher than the $1.04 seen in the same quarter in 2021, based on the ratings of 20 investment analysts.

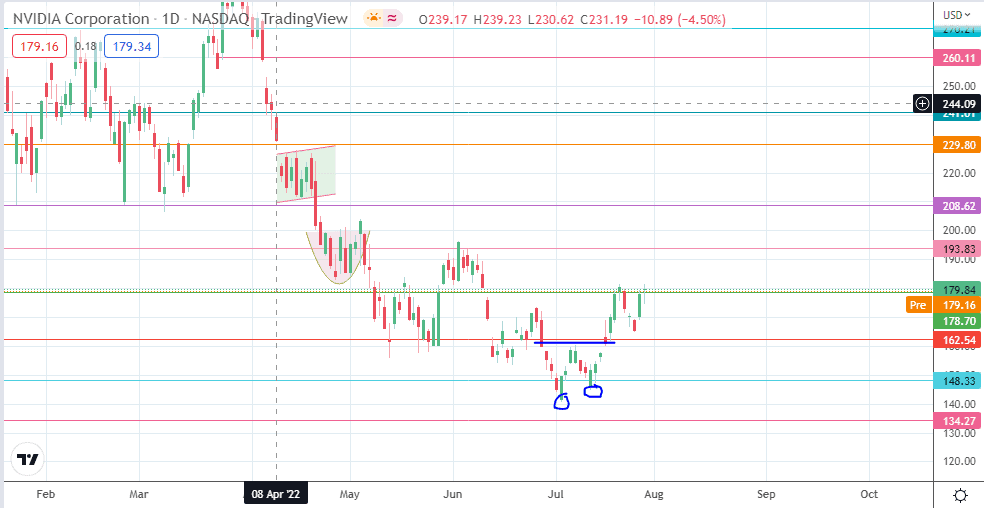

Nvidia Share Price Forecast

The price action is presently challenging the resistance level at 179.84. A break of this barrier is required for the price activity to claim the 193.83 resistance mark, where the 6 June high is found. Above this level, the 208.62 price mark serves as another upside target before the 15 March high at 229.80 comes into the picture as an additional northbound target.

On the flip side, rejection at 179.84 could enable a pullback toward the 162.54 price support (22 June and 19 July lows). A breakdown of this area targets 148.33 (30 June and 14 July lows.) before 134.27 comes into the mix as a low previously seen on 13 May 2021. Before this price point, 140.00 may come in as a pitstop, being the site of the first trough of the double top and the 5 July low.

Nvidia: Daily Chart