Nikkei 225 index trading higher as Chief Cabinet Secretary Yoshihide Suga is the leading candidate to replace Abe in the Liberal Democratic Party (LDP) election on September 14. The other two candidates for the election are Policy Chief Fumio Kishida and former Minister Shigeru Ishiba. Analysts expect that with Yoshihide Suga, there will be no significant changes in the economic policy, which is good news for stocks.

Yesterday the Jibun Bank Manufacturing PMI came in at 47.2 beating the forecasts of 46.6 in August.

The Ministry of Finance said that Japan firms’ sales in the second quarter drop to the worst level since 2009. The corporate capital spending in the 2Q posted a drop of 11.3%, marking the largest decline since 2010.

The Unemployment Rate in Japan came in at 2.9% below the estimates of 3% in July.

Wall Street yesterday hit another record high as the rally in big tech stocks continues. Sentiment improved by better manufacturing figures, with the reading from the ISM hitting its highest level in nearly two years. The ISM Manufacturing PMI registered in at 56, above the forecasts of 54.5 in August. The New Orders Index climbed to 67.6 well above the estimates of 53.5. In our economic calendar, investors will focus today in the ADP Employment Change data.

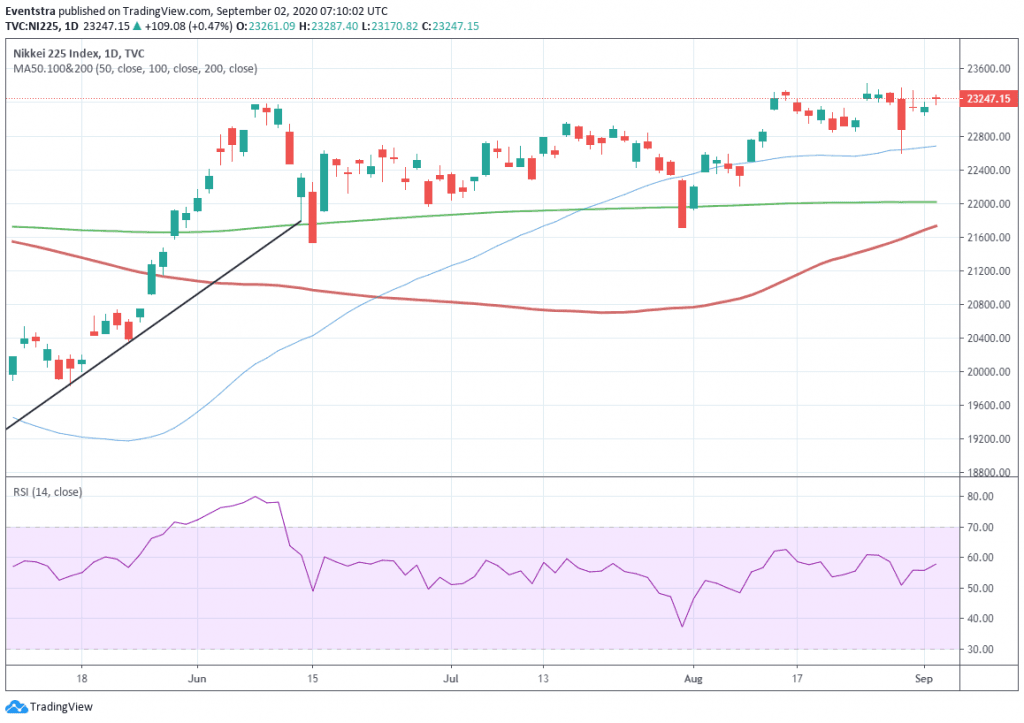

Nikkei 225 Technical Analysis

Nikkei 225 ended 0.47% higher at 23,247 as the positive momentum continues to drive the index close to monthly highs. The index tested the previous week the 50-day moving average support and bounced heading now for the yearly highs.

Resistance for tomorrow stands at 23,287 today’s highs. Next resistance would be met at 23,383 the top from August 28. If the Nikkei bulls break above, then the next supply zone is at 23,799 the high from February 20.

On the downside, support for the Nikkei 225 index would be met at 23,170 the daily low. The 50-day moving average at 22,682 would provide the next strong support. If the bears break that level, then the next target for bears would be 22,206 the low from August 7.

Don’t miss a beat! Follow us on Telegram and Twitter.

Nikkei 225 Daily Chart

More content

- Download our latest quarterly market outlook for our longer-term trade ideas.

- Follow Nikolas on Twitter.

- Do you enjoy reading our updates? Become a member today and access all restricted content. It is free to join.