- Next PLC share price has staged a comeback recently as investors' price in a steady recovery for the company. What next ahead of earnings?

Next Plc share price has staged a strong comeback in the past few weeks as investors’ price in a steady recovery for the company. The shares rose to a high of 6,894p, which was the highest point since February 28th of this year. It has risen by about 20% and outperformed other similar companies like Boohoo and Asos.

Next Plc earnings ahead

Next share price has had a difficult performance in the past few months as investors react to the rising cost of doing business. Besides, wages have grown sharply recently while the cost of other key things like logistics has risen. At the same time, the rising inflation has had an impact on retail spending in the UK. Indeed, retail sales have dropped sharply in the past few months.

Next PLC will be in the spotlight this week as the company is scheduled to publish its second-quarter trading statement. Analysts believe that the firm’s results will be significantly lower because of the rising inflation and actions by the Bank of England (BoE).

In May, the company said that its total full-price sales, including interest income, rose by 21.3%. For the full year, Next expects that its profit before tax will be about 850 million pounds. It also expects that its earnings per share will be about 557p.

Still, there are several catalysts for the Next PLC share price. First, the company recently said that it will return its surplus 220 million pounds surplus to shareholders through a dividend or a buyback. At the same time, the unemployment rate in the UK remains at the lowest point since the pandemic started. This could lead to more demand for the company.

Next PLC share price forecast

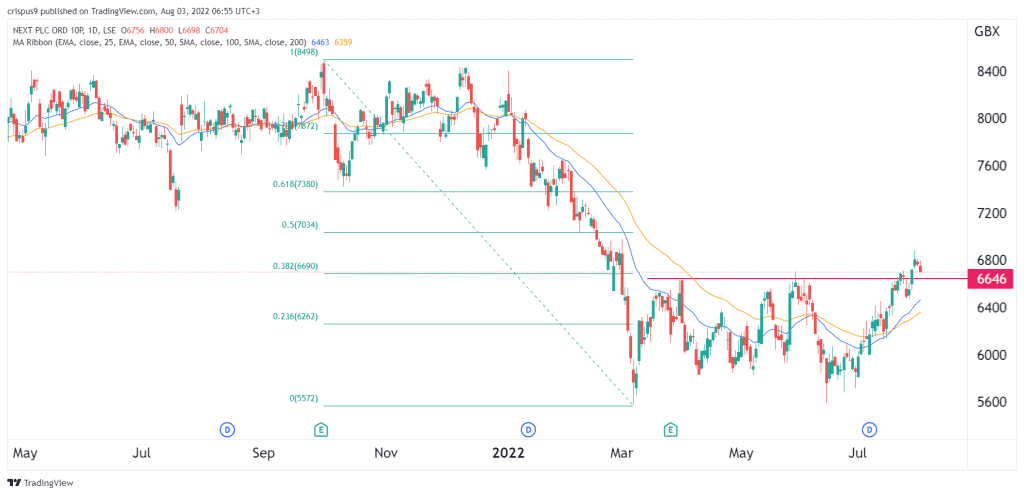

The daily chart shows that the Next stock price has been in a bullish trend in the past few days. Along the way, the stock managed to move above the important resistance level at 6,646p, which was the highest level on May 31st. The stock has moved above the 25-day and 50-day moving averages. It has moved above the 38.2% Fibonacci Retracement level.

Therefore, there is a likelihood that the Next PLC share price will keep rising as bulls target the key resistance level at 7,200p. A drop below the support at 6,500 will invalidate the bullish view.