The Nasdaq 100 index fell once more on Friday under the weight of additional selling as the Russian invasion of Ukraine continues to play out. The hardest hit were the FAANG stocks and shares of chipmakers.

The war in Ukraine has overshadowed the latest Non-Farm Payroll numbers, which showed continued recovery in the US labor market. The employment change came in at 678K, better than the market forecast of 407K after the last number registered 481K job additions. The unemployment rate dropped from 4.0% to 3.8%, which was better than the 3.9% the market was expecting.

The jobs number further cemented the expectation of Fed action in its 16 March meeting to raise rates, which in itself is an adverse market event at this time.

Nasdaq 100 Outlook

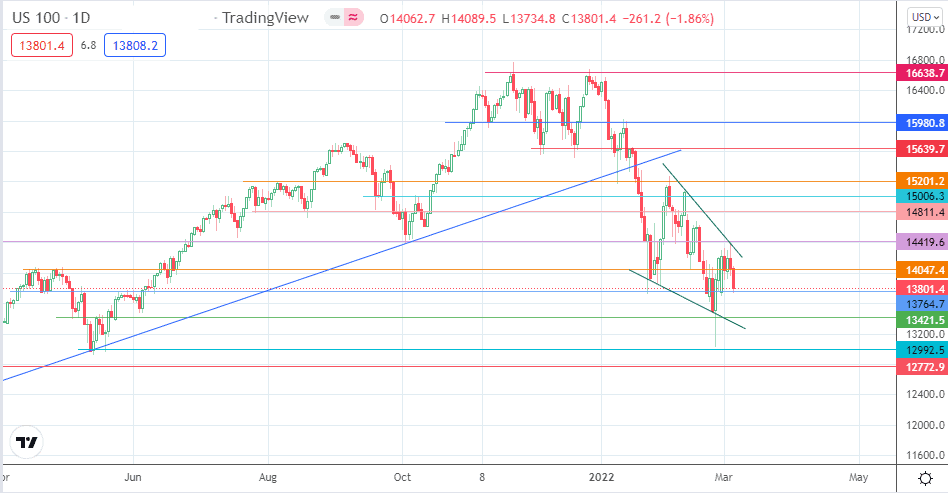

The Nasdaq 100 index’s 1.86% plunge on Friday has put the index in a direct challenge with the 13764 support. If this support level gives way, the 13421.5 pivot becomes available as a new target. At this point, a breakdown of this support also takes out the wedge’s lower border, invalidating the pattern in the process.

On the flip side, the bulls need a bounce on the 13746.7 support level to turn the price move towards the 14047 resistance. At the same time, the wedge’s upper border comes under attack from this move. If the wedge is broken to the upside, the pattern is completed. 14419.6 comes into the picture as the first target following this break. 14811.4 and 15006.3 become available as the breakout move targets a completion at the 15201.2 resistance.

Nasdaq 100: Daily Chart

Follow Eno on Twitter.