- Morrisons share price tanks as CMA orders probe into the supermarket chain's $9.7 billion takeover by CD&R.

The Morrison share price suffered a 1.64% blip in Thursday’s trading after it emerged that its latest acquisition by the Clayton, Dublier & Rice (CD&R) investment consortium would be probed by the UK’s competition regulator.

The Competition and Markets Authority (CMA) has issued an initial order of enforcement asking the supermarket group to continue operations as an independent entity while it reviews the recent $9.7 billion acquisition by CD&R. By this order, CD&R can only begin to take ownership of the company when the CMA gives the all-clear to the deal.

The CMA could take 40 days from the start of the formal investigation to decide on the deal. This is according to a report on this by Reuters.

Morrison Share Price Outlook

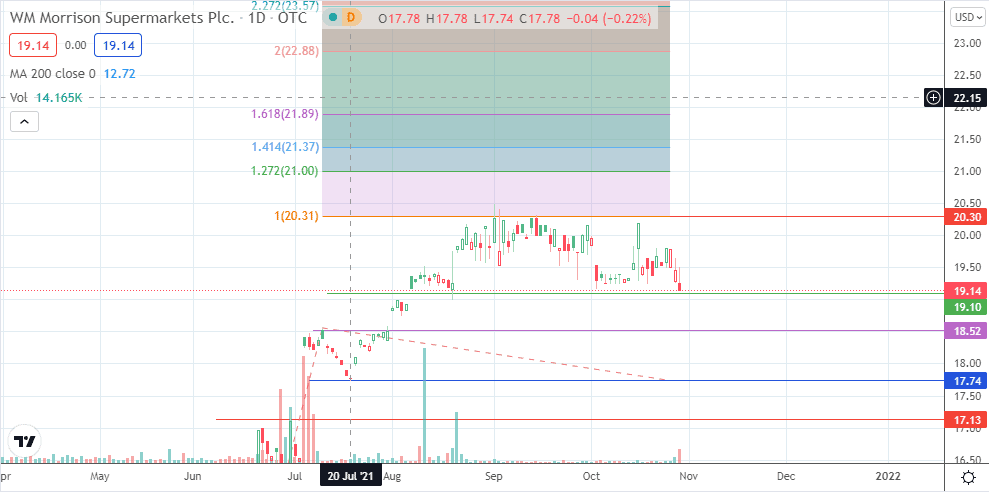

The Morrison share price is testing support at the 19.10 price mark. A breakdown of this area allows the bears to push towards the 12/30 July highs at 18.52. These levels act as role-reversed support levels, following the upside gap of 2 August, which broke that level to the upside. Below this area, 17.74 and 17.13 serve as additional downside targets.

On the other hand, a bounce on the 19.14 support allows the bulls to aim for the 20.30 resistance mark. Clearance of this barrier takes the price to new 2021 highs, with the 127.2% Fibonacci extension level and the 141.4% extension level at 21.00 and 21.37, respectively, serving as the potential upside targets.

There is also the chance that the price action may stay within the range formed by 19.14 and 20.30 until it breaks one of the two boundaries.

WM Morrisons: Daily Chart