- The Lloyds share price will face a test of its continued uptrend when the BoE releases the new interest rates next week.

The Lloyds share price is trading 1.25% lower this Thursday after starting the day with a down gap. However, the bulls are gradually asserting their dominance and are pushing to send the stock into positive territory.

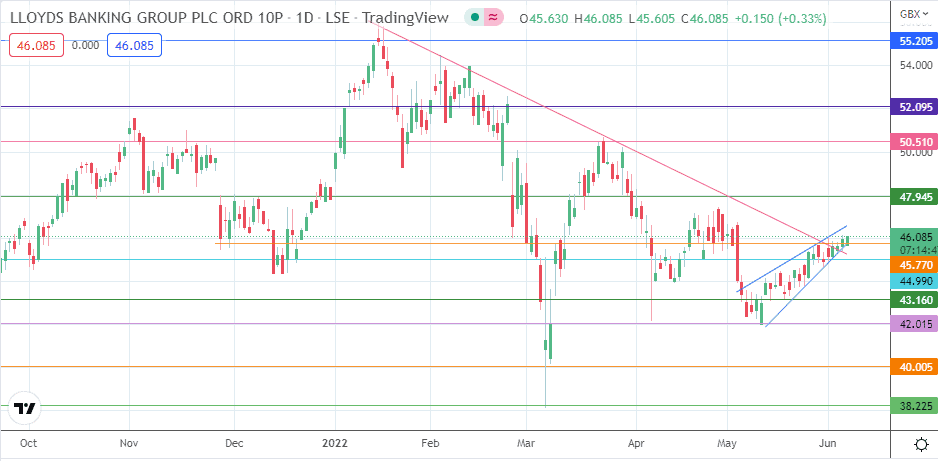

Since touching off the 42.015 low on 12 May, the stock has been on a minor uptrend ahead of next week’s Bank of England (BoE) interest rate decision. Despite the OECD warning about the UK economy as higher inflation squeezes consumer incomes and spending power, the stock continues to rise.

However, there will be headwinds around the corner to test the resilience of Lloyds share price. The bank is heavily invested in the UK property market. A report by Halifax indicates that although house prices rose for the 11th month in a row, there are signs of plateauing. The annual growth is also starting to slow.

The immediate trigger for Lloyds’ share price will be next week’s BoE interest rate decision. The BoE is expected to raise rates again, this time by 25 bps. Typically, bank stocks benefit from higher interest rates. It will be interesting to see if the trend can continue or if investors will start to back off as other fundamentals start to kick in.

Lloyds Share Price Forecast

Wednesday’s break of the 45/77 resistance with a 3% penetration close above that level has transformed this mark into a new support. The intraday bounce on the 45.77 support needs more momentum to aim for the 47.945 resistance mark (15 March and 1 April highs).

Attainment of this price level invalidates the rising wedge and also breaks the descending trendline connecting the highs of 17 January, 11 February and 23 March 2022. A continued advance beyond 47.945 opens the door toward the 50.51 price level (22 March high), before the 52.095 price area becomes a new target for the bulls.

Conversely, a breakdown of the 45.77 price mark following rejection at the wedge’s upper edge makes 44.99 a vulnerable support. A breakdown of this support leads to a breakdown of the wedge. This comes with a measured move that aims for completion at 43.16 (19 May low). 42.015 awaits the bears if the bulls fail to defend 43.16, with the psychological support at 40.005 also serving as a potential harvest point for sellers if there is further price deterioration.

Lloyds: Daily Chart