- Lloyds share price has been struggling in the past few days, which has made it cheap. Is the stock too cheap to ignore or is it a value trap

Lloyds share price is struggling today as investors watch out for the ongoing US banking earning season. The stock is trading at 35.17p, which is lower than the November high of 40.80p. Other UK banks like Standard Chartered, HSBC Holdings, Barclays, and NatWest are among the worst performers in the FTSE 100.

What’s happening: There’s no major company-specific reason why Lloyds shares are dropping today. Still, analysts believe that the stock is reacting to the overall performance of their American counterparts that started delivering their earnings last week.

Yesterday, Bank of America reported relatively strong earnings but they were weighed down by low-interest rates. In total, low-interest rates helped drag the total net income by more than 22% to more than $5.47 billion. Similarly, while Goldman Sachs and JP Morgan reported better results, they were mostly helped by trading business.

The same trend could happen in the UK, where interest rates are still at record lows. If that happens, Lloyds share price will be at risk since the bank does not have a substantial trading division to offset the interest income.

Lloyds share price outlook

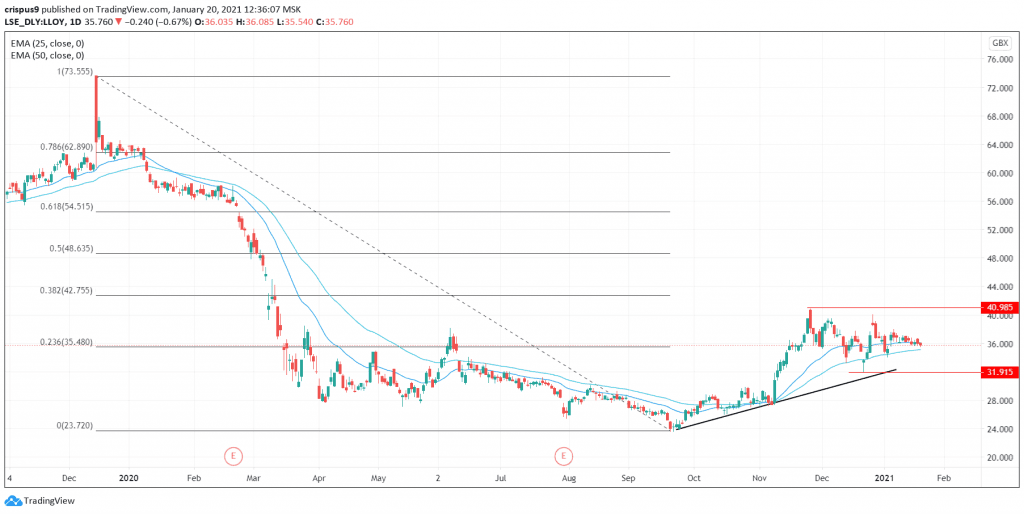

The daily chart shows that Lloyds share price formed a double-top pattern at 40.98 between November and December last year. Since then, the stock has mostly moved sideways with a bias towards the lower side. It is also on the same level as the 23.6% Fibonacci retracement and the 15-day and 25-day exponential moving averages.

Therefore, the shares will likely continue falling as bears target the next support at 31.95p, which is the lowest level since December 21.