- How should you invest $10k in stock for a short term?This question raises concern and promise all bound into one. We discuss what's tested and proven.

Financial experts usually don’t recommend putting $10,000 into stocks for investment lasting less than a year because the stock market can be quite risky and unstable over short durations. But if you’re set on this approach, here’s a breakdown of how it works, the hazards, and other safer option:

The High-Risk Approach

If you are determined to trade stocks over a short period of time, you can use active trading strategies. However, bear in mind that studies show that short-term trading generally leads to losses, especially for investors who are new to the market. Investing in stocks in the short-term can be profitable, but it’s riskier than investing for a longer time, primarily because of volatility in the market. Here’s how to go about it:

- Manage the risk: You should never risk all $10,000 on one risky trade. Instead, invest a portion of your capital wisely. A popular rule for traders is to only risk 1–2% of their capital on each trade.

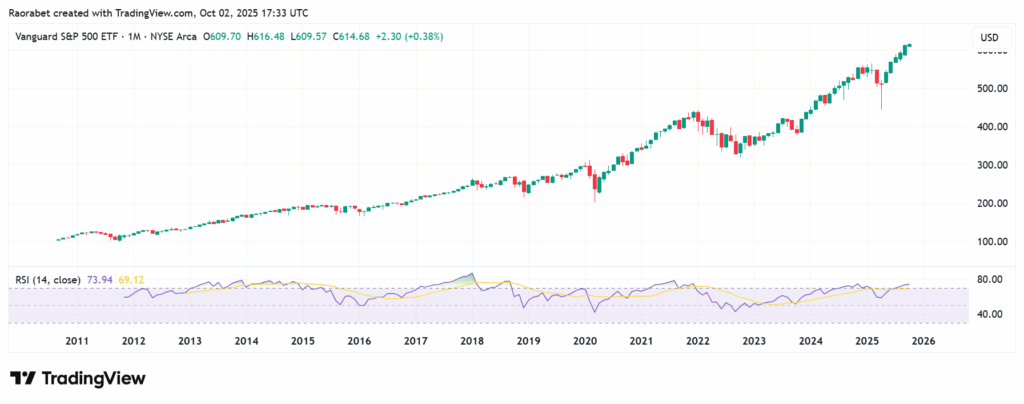

- Focus on Technical Analysis: Short-term trading depends much on correctly reading looking at chart patterns, momentum indicators (such RSI and MACD), and price levels (support and resistance) to find fast entry and exit points.

- Use active trading styles:

–Swing Trading: In this case, an investor holds stocks for a few days to a few weeks to take advantage of a price “swing” that you believe will happen. This is less risky than day trading, but you still need to be very careful on how you monitor it.

–Day Trading: Day trading means buying and selling the same stock on the same day. This is the riskiest option and requires a lot of talent, quick execution.

The Best Approach: Diversified ETF Basket and Selective Stocks

Exchange-traded funds (ETFs) that track certain sectors or indexes are one of the best ways to invest in stocks in the short-term. For instance, if an investor thinks the technology sector will do well in the next six to twelve months, buying an ETF that focuses on technology gives them a wide range of exposure without the risk of putting all their money into a single company.

An investor could put $10,000 into two or three well-chosen ETFs, which would spread the money around and focus on areas of growth. This method is safer than buying shares of only one firm because it protects against dangers that only affect that company.

A 70/30 split is the best short-term plan for $10,000. In this case, you could put 70% of it in low-volatility ETFs for stability and 30% in 2–3 high-conviction companies for growth. ETFs also make it easier to use sector rotation strategies which transfer money across sectors like energy, finance, or healthcare depending on the economy.

This protects you from big drops in one stock while letting you profit from sector rises, such those in tech or energy. To limit your losses, you should use a brokerage that doesn’t charge commissions and establish stop-losses 10–15% below your entry point. Also, check your account once a week, but don’t trade every day to avoid making decisions based on your emotions.

Vanguard S&P 500 ETF has been on an uptrend since 2011 as seen on this monthly chart. Source: TradingView

High returns should be a secondary concern to safety and liquidity if you anticipate needing the $10,000 in the next few years. High Yield Savings Accounts, Certificates of Deposits, and Money Market Funds are some examples of alternatives that probably won’t give you the best rates but will keep your principal safe.

In Summary

In summary, short-term stock plays seek to profit on dividends, momentum, or price swings. However, the risks are magnified by volatility, which is driven by economic downturns, elections, or poor earnings. To protect $10,000 against cost erosion, invest mostly with low-fee brokers like ATFX.

Also, avoid using leverage or options unless you know what you’re doing, because they magnify exposure to risk make losses bigger. Instead, mix broad exposure with specific picks to get a balanced probability. You can also focus on dividend-paying mainstays and growth companies in strong sectors like consumer staples, healthcare, and energy, which have done better than expected despite economic slowdown in 2025.

Investing $10k in stocks in the short-term is risky primarily due to stock market’s volatility over short periods (under one year) and you may be forced to sell your investment at a loss.

The safest alternatives are High-Yield Savings Accounts (HYSAs), Certificates of Deposit (CDs), and Money Market Funds.

To minimize your exposure to risk, diversify with ETFs, set stop-losses, avoid leverage and options, and monitor economic data.