- Step-by-step guide on how to become an investment banker in India. Qualifications, skills, salary potential, and career growth opportunities.

An investment banker is a consummate finance professional who helps companies, governments, and investors raise capital, issue securities, set IPO prices, and structure mergers and acquisitions. They are the bridge between businesses and their investors, providing expertise in valuation, risk management, and financial growth.

If you’re analytical, data-driven, well-spoken, and have a passion for finance, investment banking can be one of the most rewarding careers in India. This guide walks you through the education, skills, salary, and career scope you’ll need to break into investment banking in 2025.

What Does an Investment Banker Do?

Investment bankers work closely with senior management to guide financial strategy and long-term growth. Their responsibilities include:

- Monitoring markets, assessing risks, and helping clients make informed investment decisions.

- Valuing businesses using financial modelling and performance forecasting.

- Structuring IPOs, debt offerings, and equity issues.

- Advising on mergers, acquisitions, and corporate restructuring.

- Drafting research reports and pitch documents for clients.

- Ensuring compliance with regulatory frameworks.

- Building relationships with investors to unlock fresh capital.

Day-to-day work varies by firm and role, but the underlying responsibility remains the same: helping organizations grow capital efficiently while minimizing risk.

How to Become an Investment Banker in India

Step 1: Clear Class 12 Exams

Choose commerce with mathematics, economics, and business studies if possible. Strong fundamentals in these subjects will set the stage for your career.

Step 2: Earn a Bachelor’s Degree

A B.Com or BBA with a specialization in finance, accounting, or banking is the most common path. During graduation, seek internships with brokerage firms or junior analyst positions. This gives you real exposure to the industry.

Step 3: Pursue a Master’s Degree or Certification

An MBA in Finance from a top B-school (IIM, ISB, XLRI, etc.) significantly boosts opportunities. Alternatively, global certifications like CFA (Chartered Financial Analyst) or CA (Chartered Accountant) are highly valued by recruiters.

Step 4: Build Technical Skills

Investment bankers must master financial modelling, Excel, valuation, and analytics. Many now also learn tools like Tableau and Python for data-driven analysis.

Step 5: Apply for Internships & Jobs

Most banks offer structured internship programs that can lead to full-time roles. Strong communication skills, networking, and performance during internships are critical for securing a permanent position.

Top Courses to Pursue for Investment Banking in India

- B.Com (Finance/Accounting/Banking) – Foundational entry.

- BBA (Finance/Markets) – Combines management with financial skills.

- M.Com or MBA (Finance, Investment Banking, Equity Research) – For mid-level and leadership roles.

- CFA – Globally recognized, focused on investment analysis and portfolio management.

- CA – Strong in taxation, auditing, and IPO listings.

- ACCA – Global recognition, great for those aiming at international finance roles.

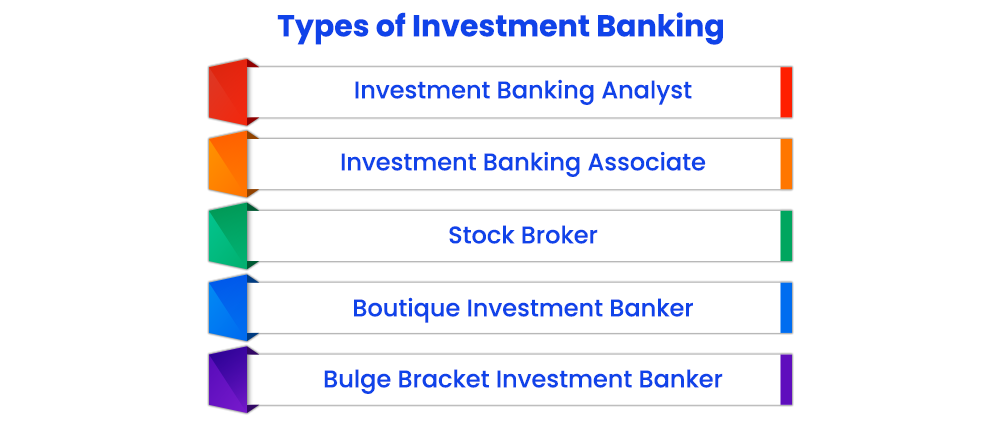

Types of Investment Bankers in India

- Investment Banking Analyst – Entry-level role focusing on research, data analysis, and building financial models.

- Investment Banking Associate – Works closely with clients, assists in valuations, and helps drive deal execution.

- Stock Broker – Facilitates buying and selling of stocks, mutual funds, and other securities for clients.

- Boutique Investment Banker – Specialist in niche services like mergers, acquisitions, or restructuring deals.

- Bulge Bracket Investment Banker – Professionals at top global banks (e.g., Goldman Sachs, Morgan Stanley) offering full-scale investment banking services.

Skills Needed to Succeed as an Investment Banker in India

| Technical Skills | Soft Skills |

| Financial modelling & valuation. | Negotiation and persuasion. |

| Excel, Bloomberg Terminal, and data visualization tools. | Networking and client management. |

| Knowledge of IPOs, mergers, and debt structuring. | Analytical mindset with attention to detail. |

| Legal and Regulatory Compliance | Confidentiality |

Benefits of Investment Banking as a Career

One of the primary reasons people pursue a career in investment banking is the compensation. The salaries and bonuses are usually much higher than most other finance roles, which makes the field one of the most rewarding.

Investment bankers get a front-row seat to global markets and big corporate decisions, which builds both technical know-how and strategic thinking. For those who perform well, promotions come fast, with the chance to move into leadership roles much earlier than in other finance careers.

On top of that, being part of landmark IPOs and major mergers gives you the sense that you’re helping shape industries, not just crunching numbers.

How Much Does an Investment Banker Earn in India?

According to Payscale and industry data:

- Entry-level analysts: ₹5-12 lakh per year.

- Mid-level associates: ₹20-35 lakh per year plus bonuses.

- Senior bankers/VPs: ₹50 lakh-₹1 crore+.

Investment bankers often receive performance-linked bonuses, and senior professionals may also get ESOPs and equity options.

Top Recruiters for Investment Bankers in India

- Global Banks: Goldman Sachs, JP Morgan Chase, Morgan Stanley, Citi, Barclays.

- Indian Banks: ICICI Bank, HDFC Bank, Axis Bank, SBI, Kotak Mahindra.

- Consultancies & Boutiques: EY, Deloitte, Avendus Capital, o3 Capital.

Is Investment Banking a Good Career in India in 2025?

Yes, but a career in investment banking is not for the faint-hearted. The field demands long hours, high-pressure deadlines, and intense competition. But for those with the right mix of technical skills and resilience, investment banking offers unmatched compensation, global exposure, and the chance to work on India’s biggest financial deals.

FAQs

Freshers often earn between ₹5-12 lakhs a year, while mid-level bankers can pull in ₹25-35 lakhs. At senior levels, pay easily crosses ₹1 crore, especially with bonuses.

Uday Kotak is widely regarded as India’s richest banker. Under his leadership, Kotak Mahindra Bank has grown into one of the country’s top four private sector banks, now valued at over ₹4.3 lakh crore.

A CA offers stability and deep expertise in taxation and compliance, while investment banking pays more but comes with long hours and pressure. The better choice depends on whether you value steady growth or high-reward, high-demand work.