- Record 2024 BFCM spending showed strong demand, and analysts expect similar momentum in 2025.

- U.S. shoppers hit new highs in 2024 BFCM spending, boosting outlooks for 2025.

- 2024’s BFCM surge signals continued consumer strength heading into 2025.

Black Friday spending data is crucial as it gives insights into how consumers are spending. Therefore, it’s one of the most-watched events by forex traders. It helps traders assess the strength of the U.S. economy.

In this article, we will explain the link between consumer spending and forex markets, how markets reacted to Black Friday spending in the previous year, and possible market scenarios.

The Link Between Black Friday Consumer Spending and Forex Markets:

The link between Black Friday spending data and forex traders comes from the fact that consumer spending is a key driver of economic growth. It’s similar to how monetary policy examines the Consumer Price Index and Personal Expenditure Index to assess the economic performance. Likewise, forex traders closely watch Black Friday spending data to assess changes in consumer spending and anticipate how this could affect the USD and USD currency pairs.

- Stronger spending data indicate that consumers are confident in the economy. Signals to a healthy economy, which can strengthen the USD as traders expect the Federal Reserve to keep interest rates unchanged. The Fed could hike the interest rates in case such strong spending causes higher inflation and prices to surge.

- Weaker spending data indicate cooling demand, which can pressure the USD lower. In this case, it’s expected that the Fed would lower interest rates to avoid cooling demand, slowing growth, and encourage consumers to spend.

In short, the Black Friday spending numbers act as a real-time pulse for checking the U.S. consumer confidence.

Black Friday Spending in Previous Years:

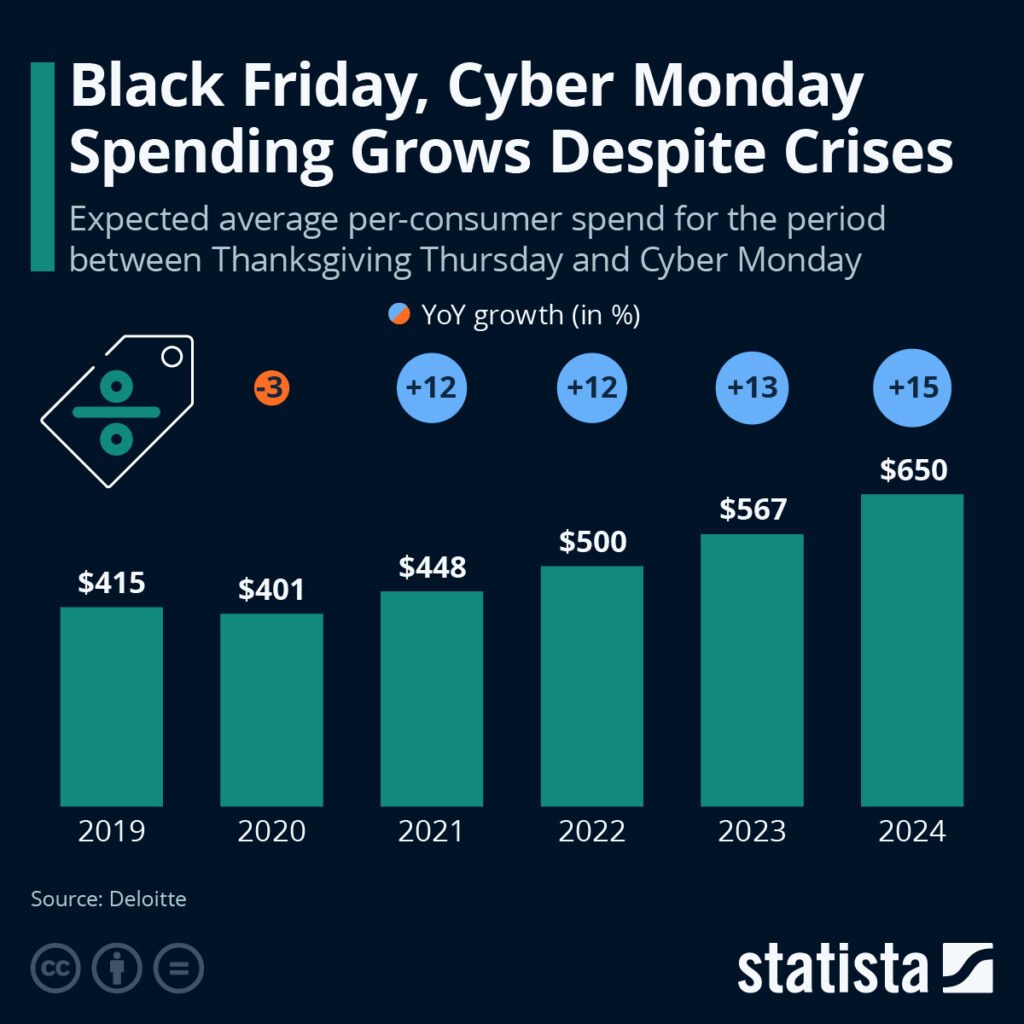

Black Friday spending has grown year over year since it began. Consumers spend more on Thanksgiving Thursday and Black Friday than usual. According to the Deloitte Black Friday-Cyber Monday survey:

The Deloitte survey reveals that:

- After a small decline in 2020 in consumer spending, due to the pandemic. It rebounded sharply and has grown every year since.

- The chart above reveals the rising year-over-year spending per consumer.

- The average per consumer spend rose from $415 in 2019 to $650 in 2024. This indicates strong consumer resilience and appetite for holiday deals, even amid inflation and economic uncertainty.

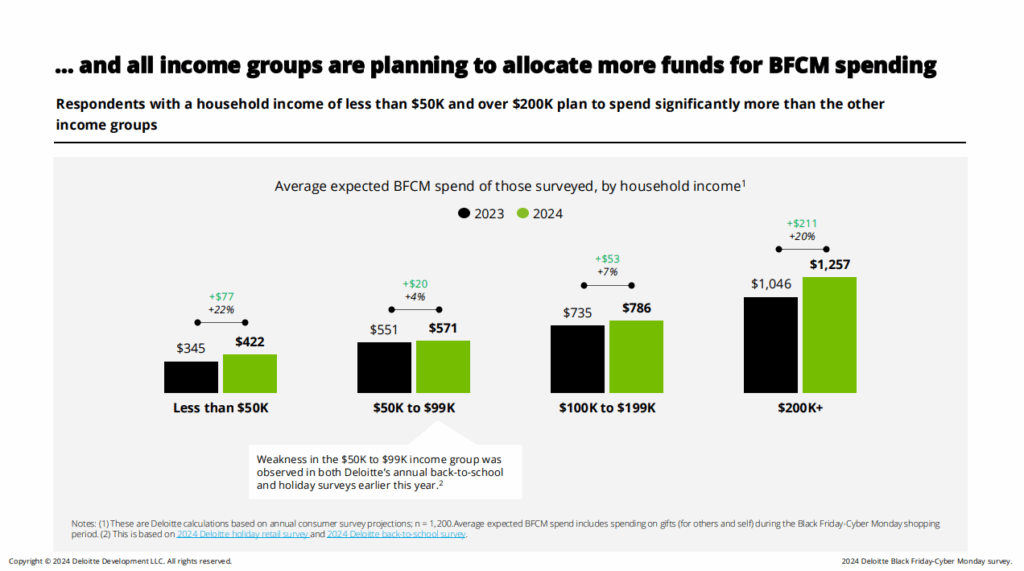

This survey shows that every income group expects to spend more during the BFCM period.

- Households earning under $50K plan a 22% rise in spending.

- Households earning over $200K expect a 20% jump.

- $50K–$99K group: +4%

- $100K–$199K group: +7%

People with lower incomes were planning to spend more in 2024, which means that they were feeling more confident or eager to take advantage of good deals. On the other hand, those with higher incomes were still the biggest spenders overall, played a major role in driving holiday sales.

Meanwhile, middle-income earners were increasing their spending only slightly, which signaled this group was a bit more cautious or under financial pressure.

For the same year, 2024, according to Reuters, on Black Friday 2024, spending:

- Overall spending in stores and online rose 3.4% year-over-year, according to Mastercard SpendingPulse.

- U.S. consumers spent about $108 billion online on Black Friday alone.

- Online sales grew by around 14% year over year.

- In-store sales grew by 0.7%.

- When accounting for inflation, one data provider found online growth at 8.5%, and in-store spending down by about 8%.

How Did Markets React to Black Friday Spending Data in 2024?

During the 2024 Black Friday deals, this title (US Retail stocks up on Black Friday)came in first on Newspapers. See below the U.S market’s performance during holiday deals as of November 29, 2024:

- The S&P500 rose 0.56%.

- The Dow Jones climbed 0.42%.

- The NASDAQ gained 0.83%.

- The small-cap Russell 2000 index rose 0.4%.

- Chip stocks rebounded, sending the Philadelphia SE Semiconductor index 1.5% higher.

Possible Market Scenarios and Trader Reactions:

According to the Klaviyo survey for potential spending during the Black Friday-Cyber Monday 2025:

- 77% of consumers are planning to spend the same or more during the 2025 BFCM deals.

- 24% of shoppers start holiday shopping before the long Thanksgiving weekend.

- 51% continue shopping until December or later.

On the other hand, Salesforce forecasts that U.S. online holiday sales will rise only 2.1% to approximately $288 billion. Despite uncertainty, the expectations show that there is potential growth in spending.

- If spending exceeds expectations:

The USD could strengthen, reflecting consumer confidence, and traders would price in stronger economic resiliency. The equity market may also rise due to improved sentiment and more sales of retail stocks. - If spending misses expectations:

The USD may weaken due to weaker consumer activity, reflecting that there are concerns about growth, weaker consumer confidence, and economic health. Rising risk-averse sentiment could support safe-haven assets like gold and JPY.

BFSM stands for Black Friday – Cyber Monday. it’s a major shopping period, signals the start of the holiday season. This holiday period reflects consumer spending trends and overall economic confidence.

Strong spending during BFCM period indicates consumer confidence is high, boosting growth expectations and sometimes strengthening the US Dollar. Conversely, weaker spending signals cool demand and weigh on currency sentiment.