- The Just Eat Takeaway share price continues to drop, but is this a buying opportunity for savvy investors?

The Just Eat Takeaway share price decline continues into the 6th day, as the company continues to reel from its delisting from the FTSE 100 exchange.

While the stock’s woes continue, the company seeks to turn the tide by going green, as it aims to introduce reusable packaging in the UK. This initiative is being run with ClubZero and will be trialed in several stores across London.

The stock still has potential for recovery, as it was identified as an undervalued stock by Bank of America. Presently, the Just Eat Takeaway share price is down 2.10% as of writing, putting the stock on the path to a 6-day decline. Could this decline present a cheaper buying opportunity for savvy investors?

Just Eat Takeaway Share Price Outlook

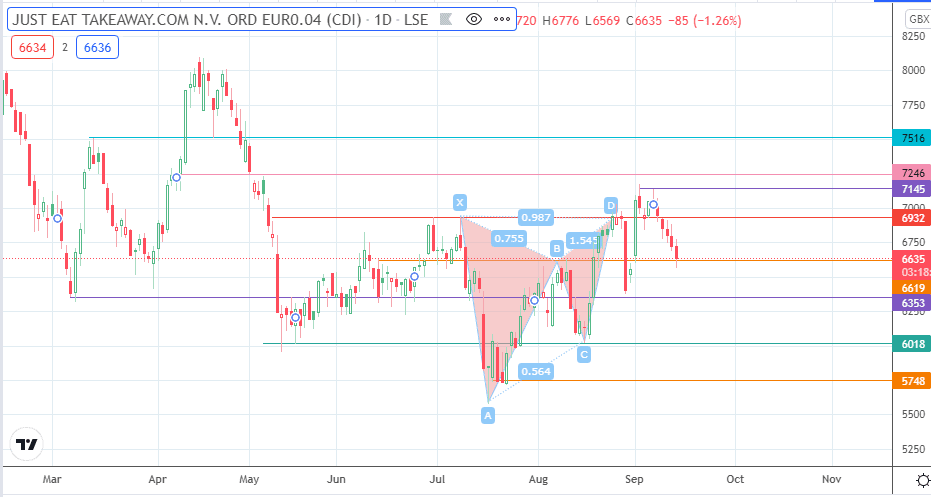

Tuesday’s decline has violated the support at 6619. A breakdown of this support clears the pathway for the price to seek a foundation at 6353. If this new pivot fails to support the price, the bears could have free reign to aim for the additional support at 6018 (18 May and 16 August lows).

On the flip side, bulls need the price to secure a bounce on the underlying support levels, ultimately targeting a break of 7415 to restore the uptrend move. This move would require a break of the 6932 resistance barrier (highs of 30 June, 24 August and 9 September). Additional targets to the north on completing this move are 7246 and 7516, in that order.

Just Eat Takeaway (Daily Chart)

Follow Eno on Twitter.