- What is the outlook of the Eurasia Mining share price? We explain whether the stock is at a bargain price or whether it is a value trap.

The Eurasia Mining share price has been in a strong bearish trend in the past few days as the prices of gold and PGMs retreat. The EUA stock is trading at 7.75p, which is close to its lowest level on March 11th. The stock has declined by more than 80% from its highest point in 2021. This decline gives it a market cap of more than 280 million pounds.

Eurasia Mining is a company that is involved in the mining of gold, Platinum Group Metals (PGM), and battery materials. The firm has operations in Monchetundra in South Africa, where it uses an open-pit method of extracting resources. The company has also launched a strategy to produce hydrogen, one of the most useful resources.

The Eurasia share price has retreated recently as the prices of gold and PGMs have dropped. Gold has declined by about 12% from its highest level in February. Similarly, platinum has declined by over 20%, while palladium has fallen by over 40%. The performance of these metals has an impact on the company’s stock.

Eurasia Mining share price forecast

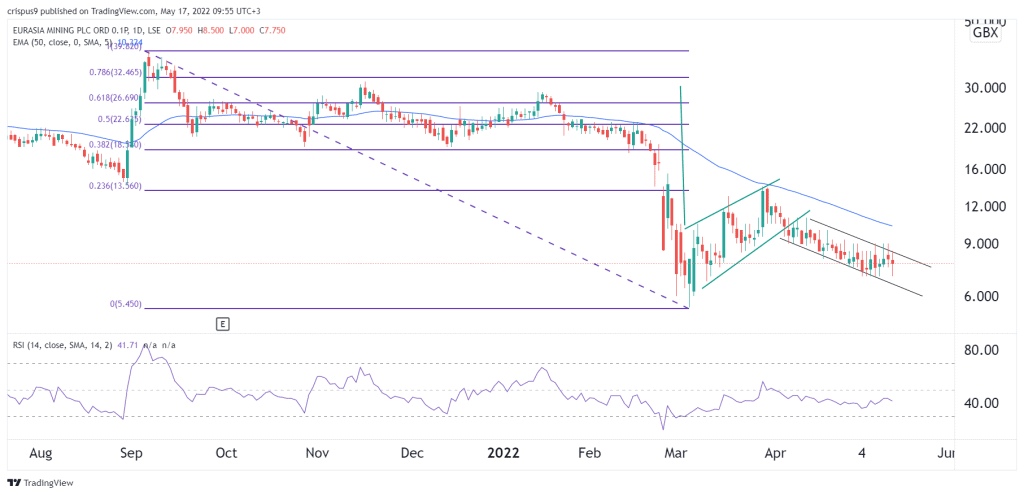

In my last note on Eurasia, I warned that the stock was ripe for a bearish breakout. In it, I pointed to the company’s shares had formed a bearish flag pattern, which is usually a sell sign. This forecast was accurate as the stock has declined by 32% since then. Moreover, the stock has continued moving below the 25-day and 50-day moving averages. In addition, it has moved below the 23.6% Fibonacci retracement level.

The shares have formed a descending channel pattern that is shown in black. Therefore, there is a likelihood that the EUA stock price will continue falling, with the next key support level to watch being at 6p. The invalidation point for the bearish outlook will be at 9p.