- Dow Jones Index near record highs as investors eye Fed policy and earnings momentum.Will resistance at 46,710 spark a breakout or a pullback?

The U.S. stock market ended last week on a bullish note, with the Dow Jones Index gaining nearly 300 points Friday as inflation data matched expectations. The latest PCE report showed price growth stabilizing at 2.7% in August, while core inflation came in at 2.9%. Investors interpreted this as a sign that the Federal Reserve may not need to raise rates further in 2025, sending buyers back into equities.

The big question this week is whether Wall Street’s momentum can continue, or if profit-taking will halt the rally.

Dow Jones Index Today: Why Investors Are Watching 46,710

Momentum in the Dow Jones Index has been building for months, with buyers stepping in every time the market takes a breather. Strength in industrials, consumer names, and big tech has kept the rally alive, lifting the index to fresh highs.

Right now, the 46,710 level is the number traders can’t ignore. It’s more than just a chart marker, it’s a psychological line in the sand. A clean break above could open the door to another leg higher into year-end, but if sellers hold the line, we could see a pause or a pullback before bulls make another attempt.

The broader setup remains supportive. Inflation is cooling, and expectations that the Fed will keep rates steady are adding fuel to the optimism. For long-term investors, it’s a constructive backdrop. For short-term traders, the big question is whether the Dow can keep this momentum intact as we head into a data-heavy week.

Dow Jones Index Chart Analysis

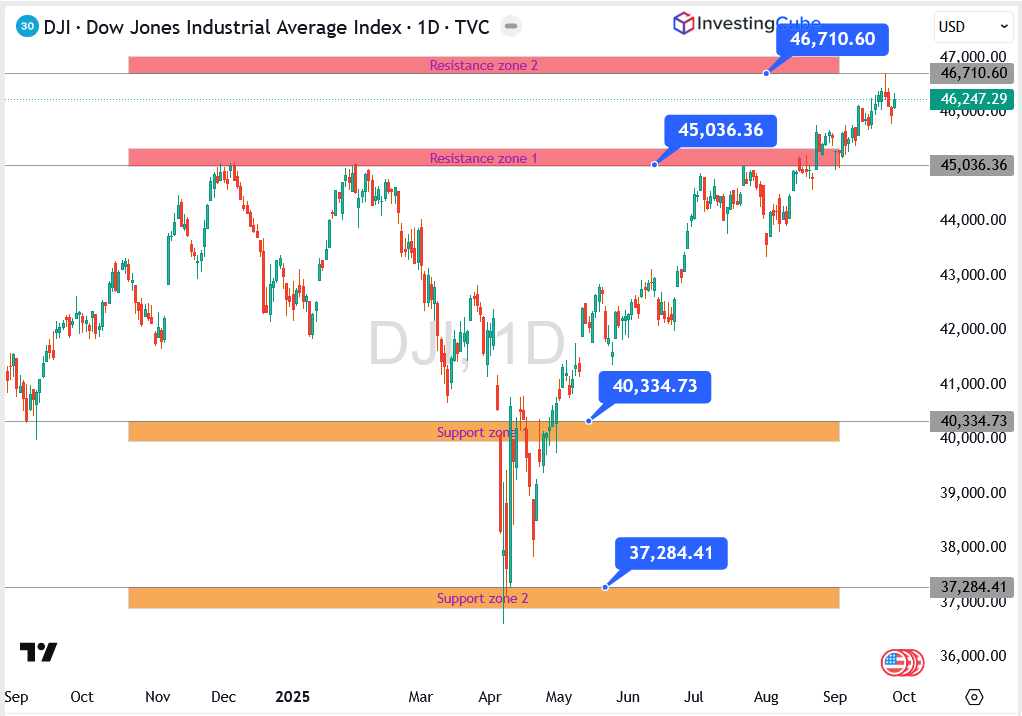

- Immediate resistance: 46,710.60. This is the ceiling traders are watching. A breakout here would confirm fresh upside momentum.

- First support: 45,036.36. If prices pull back, this zone is where buyers may try to defend.

- Major support: 40,334.73, with deeper protection around 37,284.41. Losing these levels would shift sentiment bearish.

Overall, the Dow remains in a strong uptrend. As long as the index stays above 45,036, the path of least resistance is higher, but a decisive move above 46,710 is needed to keep the rally alive.

Can the Dow Jones Index Extend Its Bull Run?

The market is at an interesting crossroad. On one hand, every dip into support has been defended, showing strong institutional demand. On the other hand, the index is extended, and profit-taking is a natural risk after such a strong rally.

If resistance at 46,710 gives way, the Dow could target fresh record highs before year-end. However, failure to break above it might bring the index back toward 45,000, a level that should act as a cushion for buyers.

For now, the path of least resistance is still higher, but traders will be paying close attention to incoming U.S. jobs data and corporate earnings this week. These catalysts could decide whether the market accelerates beyond resistance or pauses for a breather.

Dow Jones Index Outlook

The Dow Jones Index remains firmly in an uptrend. Investors are not abandoning equities, and Friday’s rally shows confidence is still there. Whether the breakout continues or not, dips into support are likely to attract buyers, making this less about a market top and more about healthy consolidation.

Dow Jones Index FAQs

Investors are betting on cooler inflation and the idea that the Fed may finally pause on rate hikes. Add in strong numbers from big tech and industrial names, and the index has kept pushing higher.

The Dow is at record levels, which excites some investors but also makes others cautious. For long-term holders it’s still a solid way to get exposure to U.S. growth, though short-term traders are more focused on the next pullback or breakout.

A surprise jump in inflation, another round of Fed tightening, or weak earnings from major companies could easily drag it down. If the index loses its big support levels, that’s when sentiment could shift quickly.