The S&P 500 Index (SPX) climbed firmly above the 6,000 mark in Tuesday’s early session, extending last week’s bullish momentum and confirming investor resilience despite recent political and valuation headwinds. The benchmark index is now flirting with new record territory, supported by tech strength, falling volatility, and fading fears over the “S&P 500 snub” controversy.

Markets initially wobbled after reports suggested institutional portfolios were lightening up on major index holdings due to weight concentration. But that anxiety proved short-lived.

A strong U.S. jobs report on Friday added more fuel to the rally, pushing the S&P 500 to within 2.4% of its all-time high. Traders are now clearly focused on macro tailwinds, especially rate cut hopes and improving earnings outlooks.

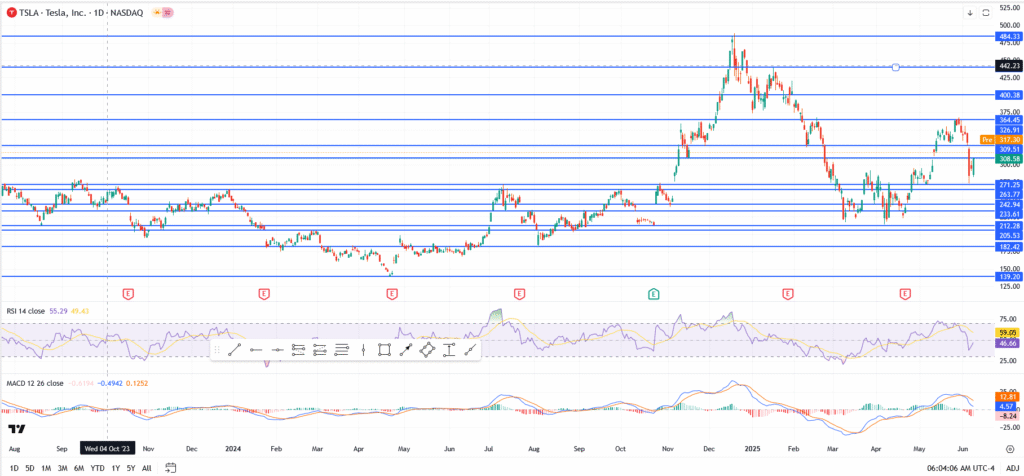

S&P 500 Technical Levels: Breakout Strength Builds

- Index cleared the psychological 6,000 barrier with conviction

- Immediate resistance sits at 6,015.64 – tested this morning

- If breached, next upside target lies near 6,147.43

- Nearest support: 5,874.44 then 5,783.44

- RSI rising at 65.47 – nearing overbought, but not stretched

- MACD remains firmly bullish with widening positive spread

With price action staying above the March-April resistance zone, the bulls remain firmly in control. A daily close above 6,015 could trigger a fresh wave of institutional inflows.

Fed, CPI Data to Set the Tone for Next Leg Higher

This week’s FOMC decision and CPI inflation report could either validate the breakout or bring back short-term volatility. But as of now, the market’s message is clear: risk appetite is alive and well.

If Fed Chair Powell keeps the door open for September easing, the rally could extend toward 6,150 and beyond.

For now, the path of least resistance remains upward.