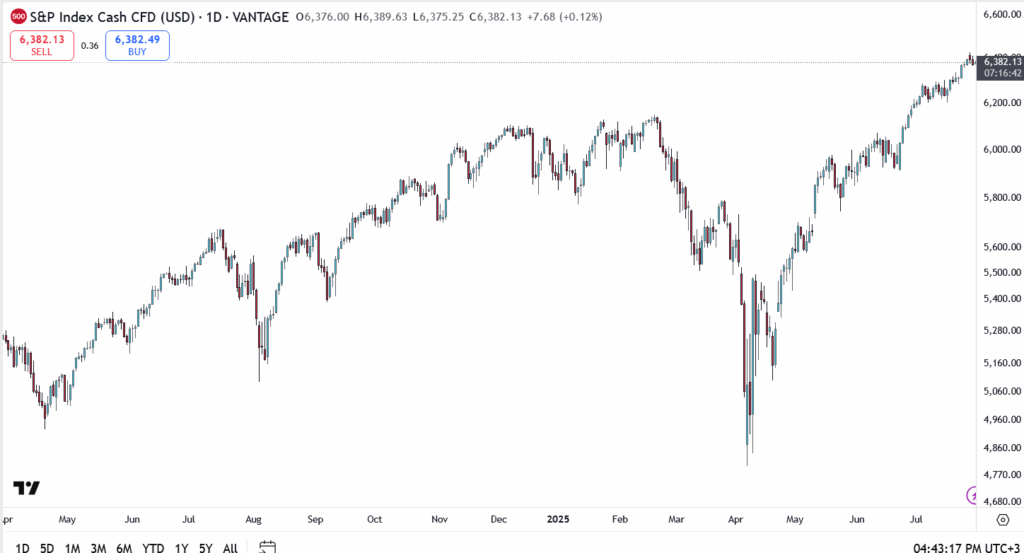

The S&P 500 opened lower on Wednesday, retreating from recent record highs as traders digested fresh headlines out of Washington and Beijing. The index is hovering near 6,382, slightly in the red, and on track to extend its early pullback following Tuesday’s modest decline. That move snapped a four-session winning streak, a sign that bullish momentum may be cooling.

Markets had been leaning on optimism around earnings and easing inflation. But with no deal yet between the US and China, investors are pausing for breath. The Fed’s interest rate decision later today is now front and center, and could either reignite the rally or send stocks into consolidation mode.

Trade Tensions Return to the Forefront

Reports from Capitol Hill confirm that US–China negotiations remain deadlocked, especially around tech-sector access and tariff relief. That’s dashed hopes of a headline breakthrough ahead of this week’s FOMC meeting.

While geopolitical uncertainty isn’t new, its return to the spotlight has added weight to an already cautious market. Risk appetite is showing cracks, especially in cyclical sectors and industrials that are most exposed to global trade flows.

Fed in Focus: Cautious or Committed?

The Federal Reserve is expected to keep rates unchanged today, but investors are bracing for Chairman Powell’s remarks. If the Fed hints at a renewed hawkish bias or delays any timeline for future cuts, it could dent equities.

Conversely, if Powell leans dovish, especially in light of cooling inflation data from last week, the S&P 500 may find support and push for another breakout.

S&P 500 Technical Picture

- Current price: 6,382.13

- Resistance: 6,400, then 6,425

- Support: 6,340, followed by 6,280

Final Take: Sentiment Is Fragile, and the Clock Is Ticking

The S&P 500’s uptrend is still intact, but momentum is thinning. With China talks in limbo and the Fed on deck, the market is walking a tightrope.

Today’s session could set the tone for August. A dovish Powell may breathe life back into the bulls. But if the Fed stays firm, and trade tensions drag on, this might be the week the rally runs out of steam.