The Sensex was off to a strong start on Wednesday, climbing more than 300 points in early trade as investors reacted to an unexpectedly soft inflation print. July’s CPI slid to 1.55%, the lowest in eight years, fuelling talk that the Reserve Bank of India could soon have room to ease policy.

Gains were led by banking, IT, and auto majors. HDFC Bank, ICICI Bank, Infosys, and Tata Motors were in green, while Reliance Industries dipped slightly as traders booked profits ahead of its ex-dividend date. Market breadth was firmly in favour of the bulls, with advances outpacing declines across most sectors.

Still, traders are not ignoring the global backdrop. The upbeat mood at home is being tempered by lingering risks from US-China trade developments and currency market swings, both of which have the potential to feed into emerging market volatility.

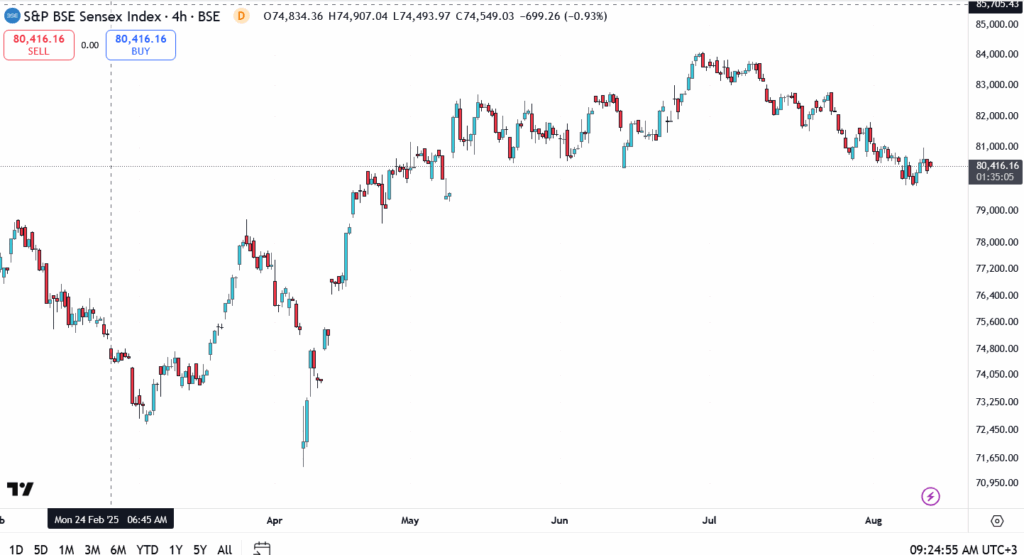

Sensex Technical Analysis

The index was hovering near 80,420 during mid-morning trade, holding comfortably above its near-term pivot at 80,100. The market has defended this area for three straight sessions, a sign that buyers are willing to step in on minor pullbacks.

- Immediate resistance: 80,800, then 81,500

- Immediate support: 80,100, followed by 79,800

Sensex Outlook

Near term, the market narrative favours the bulls. With inflation easing, the rupee holding steady, and talk building that the Reserve Bank of India might shift to a softer policy stance, the backdrop is looking favourable for more gains. Unless there’s a sudden jolt from overseas markets, the Sensex is likely to stay in buy-the-dip territory, with traders keeping one eye on global sentiment for any change in tone.

In the medium term, the real test will be whether the Sensex can push through 81,500, a ceiling that has stopped two rallies in the past month. A clean break could draw in long-only funds and keep the uptrend on track heading into September.

Right now, the early trade tone suggests domestic factors are carrying more weight than overseas risks, giving buyers the upper hand to set the pace for the rest of the week.