- Explore the Indian market's performance, key sentiment drivers, and analyze the Nifty 50's technical outlook for informed trading.

The Nifty 50 is trading with gains of up to 127 points, or 0.51%. Currently, it’s trading above the 25,200 mark. The Sensex index is also trading with gains up to 460 points, or 0.55%. It’s trading around 82,233 at the time of writing. India’s sentiment is optimistic regarding signs of progress in the negotiations between the US and China, as well as between the US and India.

On the other hand, the market’s focus is on the Federal Reserve’s upcoming interest rate decision. This announcement is expected to influence the near-term sentiment. This article looks at the Indian market’s performance, the main factors shaping sentiment, and the Nifty 50’s technical outlook.

The Nifty 50 | Indian Market’s Performance:

- The Nifty 50 has gained 0.51%, currently trading around 25,239, near its June high of 25,266.

- The Indian Oil and Gas stocks have extended gains for the fifth consecutive trading session.

- The S&P BSE Sensex rallied more than 400 points, reaching a high of 82,246 this morning.

- The S&P BSE Mid-Cap index rises to around 171.05 points and trades around 46,539.05.

- The S&P BSE Small-Cap index rises to around 286.56 points and trades around 54,191.15.

Nifty 50 Top Gainers:

- Kotak Mahindra Bank gains 2.5%.

- Larsen & Toubro gains 1.78%.

- Axis Bank gains 1.47%

- Bharti Airtel gains 1.14%

- UltraTech Cement gains 1.27%

Closely watched Stocks:

- Shares of JSW Infrastructure gained 2.24% in response to signing a 30-year concession agreement with the Syama Prasad Mookerjee Port Authority.

- Larsen & Toubro gained 1.05% and became one of the top gainers. That’s because its Heavy Civil Infrastructure division received a major order from the Nuclear Power Corporation of India for a project in Tamil Nadu.

- Sattrix Information Security jumped 5% after its U.S. joint venture, World Tech Nexus LLC, completed business registration.

The Key Factors Shaping the Global Market Sentiment:

- During the US-China talks held in Spain, US President Donald Trump signaled progress in trade negotiations. He has approved the extension of current U.S tariff rates on Chinese goods, totalling about 55%, until the tenth of November.

- This decision led the Asian market to trade mixed on Tuesday, with investors hoping tariffs would be eased or that further improvements would be reached.

- The upcoming talks between U.S. President Donald Trump and Chinese President, XI Jinping are on Friday. They will discuss the terms of agreement on the divestment of Chinese-owned TikTok.

- Investors’ focus has shifted to oil prices today due to potential supply disruption from Russia after Ukraine’s drone attacks on its refineries.

- The market awaits the Federal Reserve’s decision on the US interest rate tomorrow.

- According to the CME Fed tool, market participants are pricing around a 90% probability of cutting rates by 4%-4.25%.

The Nifty 50’s Technical Outlook

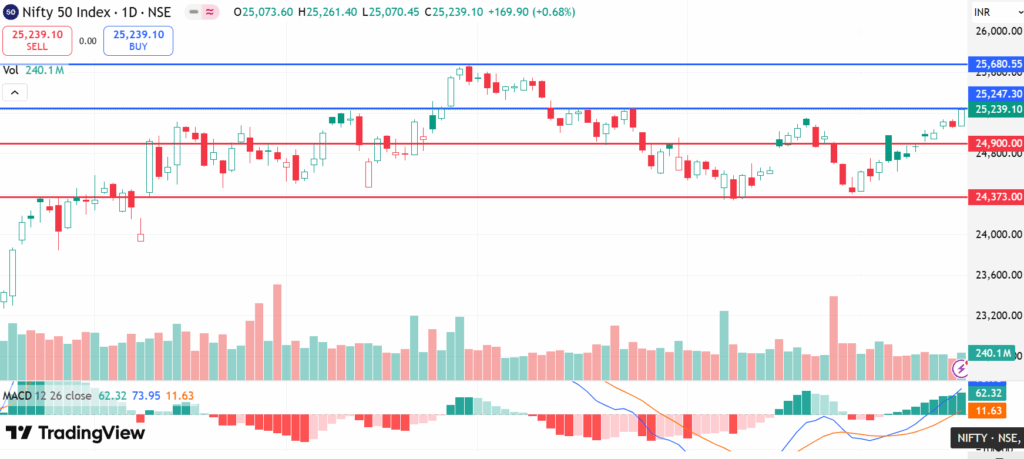

From a technical perspective, the Nifty 50 index is trading now above the key support level of 24,900. It’s approaching 25,400. With MACD signals pointing to a bullish momentum on the daily chart. A clear daily close above 25,300 could open the way toward 25,400. A breakout above the 25,500 may push the price higher to 25,680.

On the bearish side, if the Nifty 50 loses momentum above 24,900 and retests this level. The Nifty 50 may face pressure below this key support. A clear day close below 24,900 could open the way to reach the 24,373 support level.

The Nifty 50 is India’s benchmark stock market index, managed by the National Stock Exchange. It tracks the performance of the 50 largest and most liquid companies across key sectors of the economy. The index is widely used as a barometer of India’s equity market and overall economic health

You cannot directly invest in the Nifty 50 index itself, because it’s not a tradable asset, but you can get exposure to it in two main ways.

The first option is through ETFs (Exchange Traded Funds), which let you track the index at low cost with easy diversification.

Traders looking for short-term opportunities can use the second option, CFDs (Contract for Difference), to speculate on Nifty’s price movements with leverage, though this comes with higher risk.