- The Federal Reserve is widely expected to slash interest rates in December 10, and a surprise could jolt the markets.

- Foreign Institutional Investors have continued with their selling this month, but domestic investors are providing some reprieve.

- A break below the psychological 25,000 points could accelerate the decline.

Nifty 50 Index, the Indian equity benchmark, has experienced a noticeable slide since the start of December, snapping previous upward momentum and stirring up cautious sentiment among investors. So what’s going on?

Fed Interest Rate Decision Jolts Markets

The primary driver of the recent bearishness appears to be a heightened sense of global uncertainty, particularly surrounding monetary policy. Investors have been on edge, adopting a defensive posture ahead of the highly anticipated U.S. Federal Reserve’s interest rate decision, which many expect to be a 25 basis point cut.

The fear is that the Fed might keep rates steady, which could strengthen the dollar and hurt emerging markets like India. A general slowdown is happening in global markets, and a lot of central bank meetings are planned around the world, making people even more cautious, say financial analysts.

Pressure from Foreign Institutional Investors (FII) Outflows

Foreign institutional investors (FIIs) have been selling off stocks, taking money out because of global worries. The National Stock Exchange reports that foreign investors sold shares worth ₹12,000 crore in the first week of December alone, continuing a trend from November. This is happening because of concerns over the Fed’s policy meeting on December 10.

The weekly futures and options expiry on December 9 increased market swings, with the Nifty falling below the important 25,800 support level. This level is a psychological barrier, and analysts warn that more selling could occur if the index stays below it.

Near-Term Rebound Potential and Triggers

A near-term rebound is certainly possible, but it will require a definitive shift in the current landscape. Market analysts believe that any sustained recovery will likely remain fragile until clarity emerges on global monetary policy and foreign capital flows.

A rate cut announcement from the U.S. Federal Reserve meeting would be the biggest thing that could trigger a rebound. If the Fed cuts rates and suggests a continued easing cycle, it would reduce global risk, strengthening the rupee and encouraging foreign investors to reduce selling. A sustained increase in domestic investor buying could also help. Domestic investors have been net buyers, helping to balance the foreign investors’ selling.

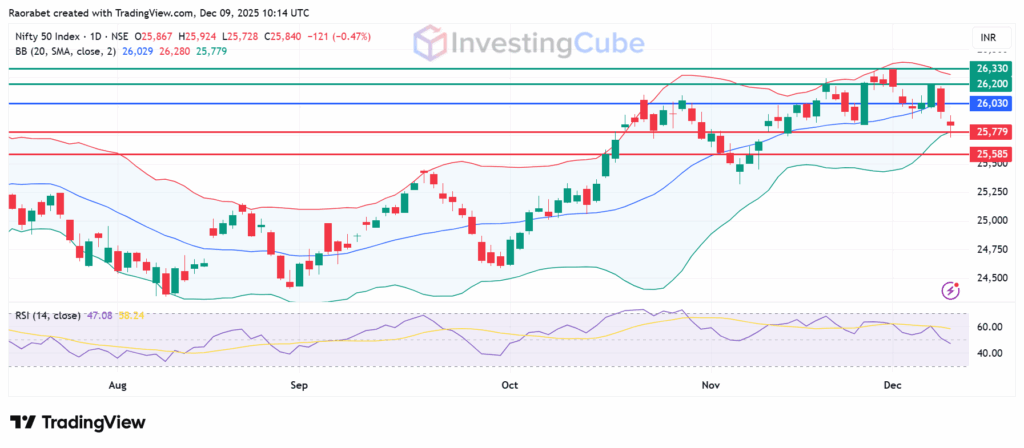

Nifty 50 Index Chart

The Nifty 50 index has its pivot at 26,030, which is at the middle Bollinger Band. The primary key support is at 25,779, aligning with the lower band. However, an extended control by the sellers could push the action lower and test 25, 585. The RSI is at 47.08, confirming the downward momentum.

Conversely, the buyers will have taken control if the Index goes above 26,030. The immediate resistance level for any upward movement is likely to be around 26,200. If the index breaks above that mark, it will invalidate the downside narrative and show a stronger momentum that could go on to test 26,330.

Nifty 50 Index daily chart on December 9, 2025 with key support and resistance levels created on TradingView

On December 9, expiry-day volatility intensified as the Nifty breached 25,800 support, triggering stop-losses and fresh shorts. Analysts are warning of accelerated selling below this level, with open interest buildup at 25,700 puts signaling downside bets.

FIIs are net sellers, pulling out capital due to global risk-off sentiment and the continuous depreciation of the Indian rupee. This persistent selling pressure is a major contributing factor to the Nifty’s downward trend since the start of December.

A positive or dovish outcome from the U.S. Federal Reserve meeting, where a widely anticipated rate cut is confirmed, would be the strongest catalyst.