- Explore the latest Nifty 50 news, the H-1B visa fee decision, and crucial index price levels. Get informed and make smart financial choices.

The Nifty 50 closes lower by 96.55 points or 0.38%. At the same time, the BSE Sensex Index slips 171.39 points or 0.21%. This comes in light of the US President Donald Trump’s latest plan to overhaul the American immigration system.

On Friday, Donald Trump, with Commerce Secretary Howard Lutnick, signed a proclamation that will require a new fee for H-1B visas (for high-skilled jobs that tech companies find hard to fill).

The fee is hiked to $100k. This decision has left immigrant workers confused. They are unsure whether they have to renew their visas. And for those outside America who hold this visa, a new question arises: should they reissue it and pay the new fee?

This decision raises Indian’s fear because more than 70% of H-1B visa holders are from India. That’s why India’s IT stocks were negatively affected.

A posting on X by White House secretary Karoline Leavit answered these concerns. “This applies only to new visas, not renewals, and not current visa holders.”

Moreover, the white house, to make this new rule clear, said in social media posts, “Doesn’t impact the ability of any current visa holder to travel to/from the U.S.”

India’s Government’s Reaction to H-1B Visa Fee:

- India’s government sees that this fee hike would dramatically raise the fee for visas that bring tech workers from there and other countries to the United States.

- India’s Ministry of External Affairs said:

- “was being studied by all concerned, including by Indian industry.”

- “This measure is likely to have humanitarian consequences by way of the disruption caused to families. Government hopes that these disruptions can be addressed suitably by the U.S. authorities.”

How does the H-1B Visa Fee Hike Affect the IT Stocks in India?

- The domestic benchmark Nifty 50 witnessed a significant fall in order to a sharp fall in IT stocks. This was triggered by the US government’s decision to increase the H-1B visa fee to $100k.

- This decision will raise the operational cost for indian IT companies reliant on these visas.

- The Nifty 50 opened 96 points lower.

- The BSE Sensex opened 435 points lower.

- The Bank Nifty opened higher by 0.02% at 55,470.

- On the other hand, the small and midcap stocks opened lower.

- Nifty Midcap opened 142 points lower at 58,952.

- The H-1B decision will also affect the US companies which hiring indian or foreign talent.

- In the short term, indian IT companies will be negatively impacted. While in the long run, the US firms will bear it.

The Nifty 50’s Top Gainers:

- Adani Enterprises.

- HDFC Life.

- SBI Life Insurance.

- Power Grid Corp.

- Bajaj Finance.

The Nifty 50’s Top underperformers:

- Tech Mahindra.

- Infosys.

- TCS

- Wipro

- HCL Technologies.

Key Price Levels to Watch for the Nifty 50 Index:

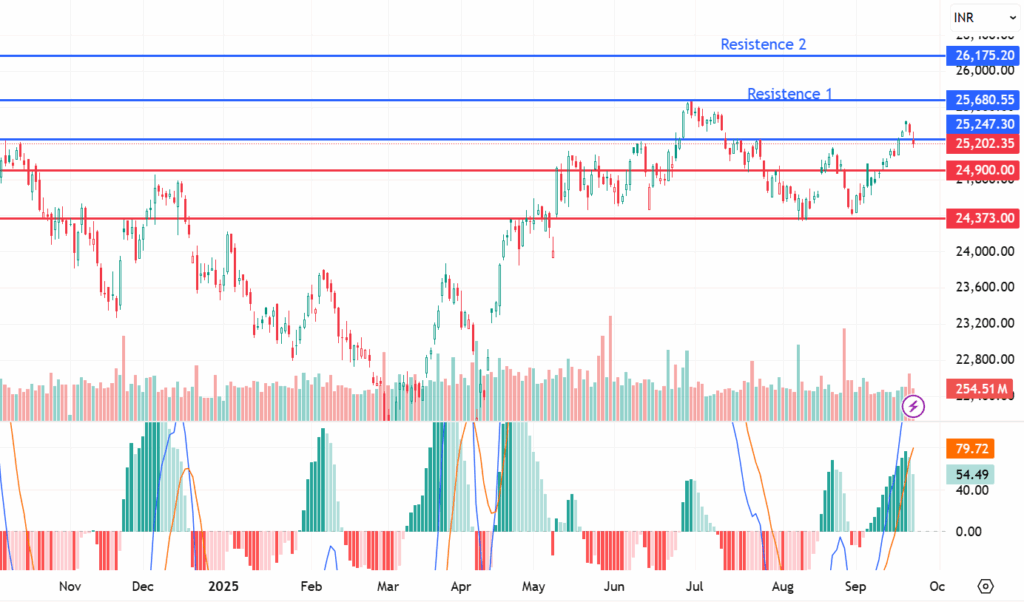

From a technical perspective, on the daily chart, the Nifty 50 index is facing pressure at the resistance level of 25,680. If the index opens below the 25,000 mark, a clear 4-hour close under this level could pave the way toward 24,900 and then 24,373 in a bearish scenario.

However, the MACD indicates a bullish momentum on the daily chart. A bearish correction may occur in the near term, but the overall bullish scenario remains intact for the indian benchmark index, Nifty 50

A decisive move above the 24,500 level could be essential to trigger a continuous uptrend. In the bullish scenario, the index is targeting R1, 25680, and then R2 at 26,157.

Also check last week analysis for the USD/INR currency pair.

The Nifty 50 is a benchmark stock market index in India. It represents the weighted average of the 50 largest indian companies listed on the National Stock Exchange. It serves as a key indicator of the overall performance of the indian economy.

The Nifty 50 is a free-float market capitalization-weighted Index. Which means that the company’s influence on the index’s value is determined by its total market value, adjusted for the number of shares available for public trading.

Nifty 50 is owned and managed by the National Stock Exchange indices (NSE). This is a wholly owned subsidiary of the NSE Strategic Investment Corporation Limited.