- KSE 100 rebounds above 103,700 after sharp selloff. Karachi Stock Exchange recovers amid India-Pakistan tensions...

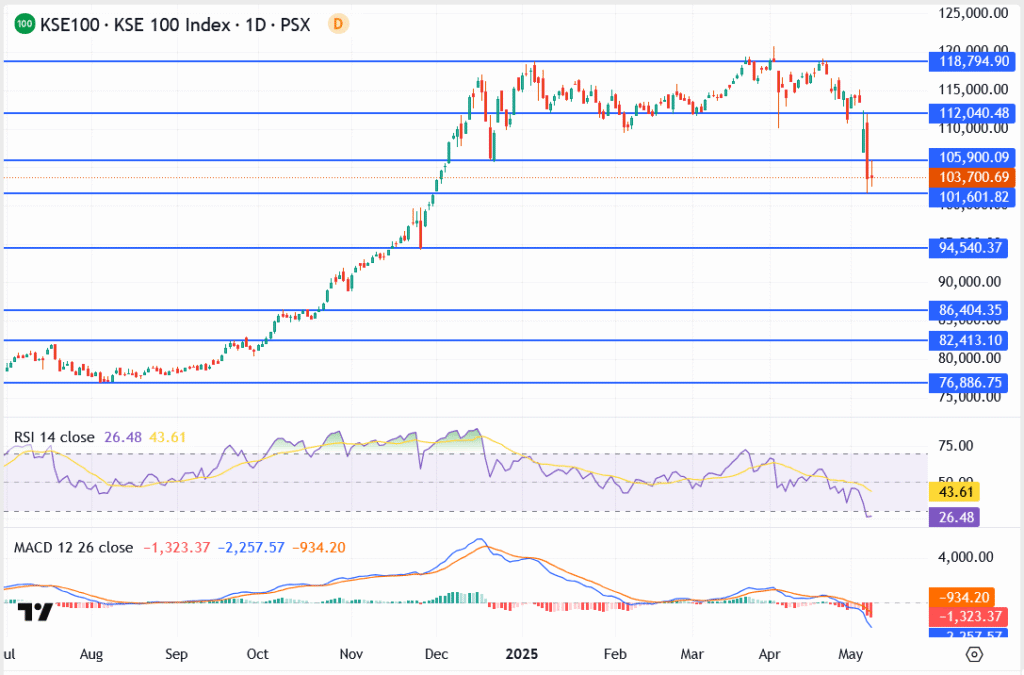

The KSE 100 Index, the benchmark stock index of the Pakistan Stock Exchange (PSX), based in Karachi, clawed back losses on Friday, bouncing above 103,700 after a punishing week. On Wednesday, the index nosedived nearly 6% in a single day, driven by a sudden spike in India-Pakistan tensions that spooked investors and triggered circuit breakers.

The exchange briefly halted trading after the benchmark plunged 6% in a single day, its worst slide since mid-2023

But Friday’s bounce doesn’t mean we’re out of the woods.

KSE 100 Chart Analysis

- Support: 101,601 — defended hard this week

- Next floor: 94,540 — low from December’s panic leg

- Short-term resistance: 105,900

- Oversold read: RSI touched 26.48, suggesting a technical bounce

- Stronger ceiling: 112,040 – major hurdle for bulls

- MACD: Still bearish — sellers haven’t left the room yet

For now, the rebound looks more like a dead cat bounce than a full recovery. Momentum remains negative, and with geopolitical uncertainty still swirling, volatility is likely to stick around.

What’s Next For KSE100 Index?

Unless KSE100 can reclaim and hold above 105,900, this could be just a breather before the next leg lower. A slide back under 101,600 would expose the index to deeper losses, possibly into the 94,000 zone.

For short-term traders, this is a wait-and-watch market. For long-term investors, it’s a reminder that risk isn’t gone; it’s just regrouping.