- In this article, we discuss the momentum and sentiment propelling the FTSE 100 Index and assess how soon it could reach 10,000 points.

The FTSE 100 Index has had a terrific couple of weeks. London’s top index has achieved new all-time highs, and many investors are asking what is driving this strong rise and, more importantly, when the magical 10,000-point threshold might be broken.

The Fuel Behind FTSE 100 Surge

Corporate profits are where we begin, and they have been excellent. On October 29, GlaxoSmithKline (GSK) stole the show by upping its sales forecast for 2025. This caused its shares to rise 6.5%, which raised the whole index to a new high.

On that same day, the retailer Next and the pharmaceutical company AstraZeneca both made positive forecasts. In addition, banking giants HSBC and Standard Chartered, were able to ignore global challenges and still record good results. Earnings season has turned into a parade of good news, with London’s biggest corporations repeatedly surpassing expectations and giving investors more dividends and buybacks.

Rising commodity prices have also been a major catalyst. As reported by Bloomberg, U.S. President Trump’s sanctions on Russian oil companies Rosneft and Lukoil on October 23 caused crude prices to rise sharply. In turn, that helped energy giants like BP and Shell and pushed the FTSE 100 higher. At the same time, the pound has lost over 2% of its value versus the dollar over the same time period. That has boosted the profits of the index’s global exporters.

When will FTSE Reach 10,000 Points?

The climb above 10,000 points has become a major topic, especially since the index has been going up, with highs above 9,700. There is a lot of momentum right now, but experts are being a little more careful about the short-term timescale.

If the present trend continues, some analysts predict that the index might hit 10,000 by Christmas. The index’s strong dividend yield, defensive mix of miners, pharma, and financial companies, and the positive benefits of a weaker sterling all support this. But some expert predictions are more cautious. For instance, Citigroup recently raised its mid-2026 projection for the FTSE 100 from 9,300 to 9,700. This is good news, but it’s still not a five-figure number.

Fidelity International analysts have indicated that the fair-value target for the FTSE 100 is 10,470 based on future profits and valuation multiples. This means that there is still a lot of room for growth. More optimistic voices, like those at the Economy Forecast Agency, say that the FTSE might reach 11,600 by the middle of 2027 if the current growth and currency trends continue.

Technical Analysis

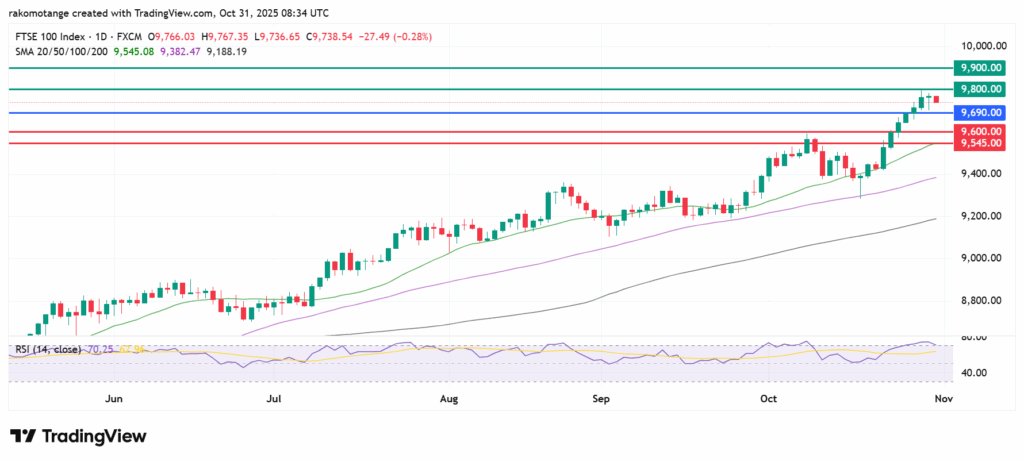

According to TradingView data, the FTSE 100 is in a confirmed uptrend, trading well above its 50-day simple moving average at 9,679 and its 200-day SMA at 9,516. Both these levels are strong buy signals.

There aren’t any historical resistance levels above the recent all-time highs, but the 9,800-point level has recently acted as a temporary barrier. That level will likely be the initial resistance level. Beyond which the second one could come at 9,900. If it breaks above, it might go to 10,000. On the downside, the first support level is at 9,600 points and an extended control by the sellers could send the action lower to test the 20-day SMA at 9,545 points. The RSI at 70 shows that the market is moving in a healthy way and isn’t overly overbought.

FTSE 100 Index daily chart with 20,50 100 and 200 SMA. Source: TradingView

The index has primarily been propelled by a weaker pound, strong earnings from corporations like GSK, Next, and banks. Also, stocks of oil giants like BP and Shell have been pushed up by rising oil prices.

There’s a strong possibility that FTSE 100 Index could reach 10,000 points, according to some analysts. The index has a strong momentum and fair valuations that point to a breakthrough by late 2025.

The FTSE 100 is highly exposed internationally. A weaker Pound means these foreign earnings translate into higher profits when converted back into Sterling.