- Discover insights into the FTSE 100 and mixed UK stocks, with a spotlight on Babcock and Halma. Check it Now!

The FTSE 100 opens lower by 35 points at 9,216 during opening trades. The UK stocks are trading in a mixed way. The mix of medical, mining, and financial companies affects the index’s performance.

The biggest downperformers by the initial trades are Conva Tec, down by 4.8%, Endeavour Mining, down by 3.7%, Phoenix Group, down by 4.75%, and Antofagasta, down by 2.1%.

While the top performers are Rio Tinto, up 1.8%, followed by Halma PLC. It has hit its all-time high, up almost 3% to reach 3,430.

This is considered a strong first half for Halma. Despite mixed market conditions and an escalating geopolitical environment.

Halma PLC raised its full-year outlook, now expecting revenue growth in the low double digits, compared to its earlier forecast of upper single digits.

The upgrade comes from stronger-than-expected growth in photonics within the Environmental & Analysis sector, and higher orders intake versus last year.

Babcock Updates | FTSE 100 Defense Company:

- Babcock reports “encouraging” trading in the first five months, with organic revenue growth and margin progress in line with expectations.

- Full-year guidance unchanged, while medium-term upgraded in June.

- Strong Nuclear and Aviation growth, plus Marine expansion, partly offset by weaker Land division due to lower rail activity.

- The 200 GBP million share buyback is 25% complete, on track to finish by year-end.

FTSE 100 News | Petershill Partners Plans Major Payout and LSE Exit:

Goldman’s Petershill Partners investment trust plans to go private.

- Petershill Partner plans to return $921M to shareholders and delist from the London Stock Exchange.

- Ordinary shareholders will receive $4.15 per share in cash plus a $0.052 dividend, totaling $4.202 per share.

- The payout represents a 41% premium to the six-month average share price.

- The board states the share price has not reflected the company’s asset quality, strong financial performance, and growth potential.

FTSE 100 | Fundamental Overview:

The FTSE 100 looks fragile after yesterday’s gains driven by a mining rally, with copper prices spiking on Freeport-MCMoran’s supply warning.

The European markets show broad weakness, and concerns grow over a potential market top amid AI sector worries and high valuation levels.

Precious metals miners show mixed performance, the Q3 earnings season approaches, and sterling steadies after BOE hints of rate cuts, as investors caution rises ahead of the UK Budget.

However, the BOE indicated it may slow the pace of rate cuts amid ongoing inflation pressures in the UK. Inflation remains the highest among G7 nations, at 3.8% in August, with BOE projecting a peak of 4% in September befores easing toward its2% target by spring 2027.

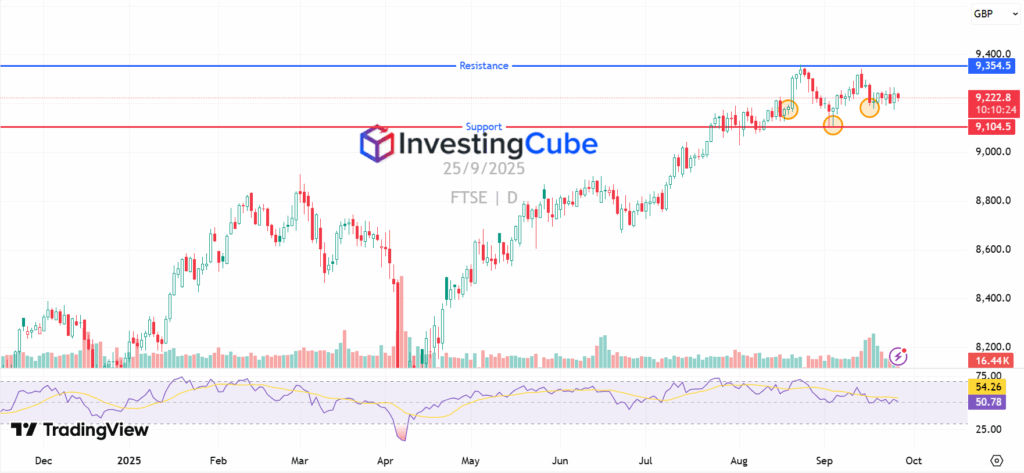

The FTSE 100 Technical Outlook:

Technically, the FTSE 100 is under pressure at the resistance level of 9,354. The price action on the daily chart forms an inverse head and shoulder pattern. This pattern indicates a potential bearish-to-bullish trend reversal, signaling that a downtrend is likely ending and an uptrend is beginning.

A clear 4-hour close above 9,357, which is its all-time high, could pave the way toward 9,400. On the bearish side, the FTSE 100 may retest the head of the pattern at 9,104.

The RSI is at the 50 mark, indicating a balance between bullish and bearish positions. This reflects how the market is trading cautiously until any external or fundamental factors change the sentiment.

The FTSE 100, Financial Times Stock Exchange 100 index, is a stock market index that represents the 100 largest companies listed on the London Stock Exchange by market capitalization. It’s widely used as a benchmark for the performance of the UK stock market. Companies in the FTSE 100 include well-known global firms such as BP, HSBC, Unilever, and AstraZeneca. The index reflects overall investor sentiment and the health of the UK economy.

The FTSE 100 began on 3 jan 1984 at the base level of 1000. Its highest closing value is 9,321.40. It was reached on 22 August 2025.