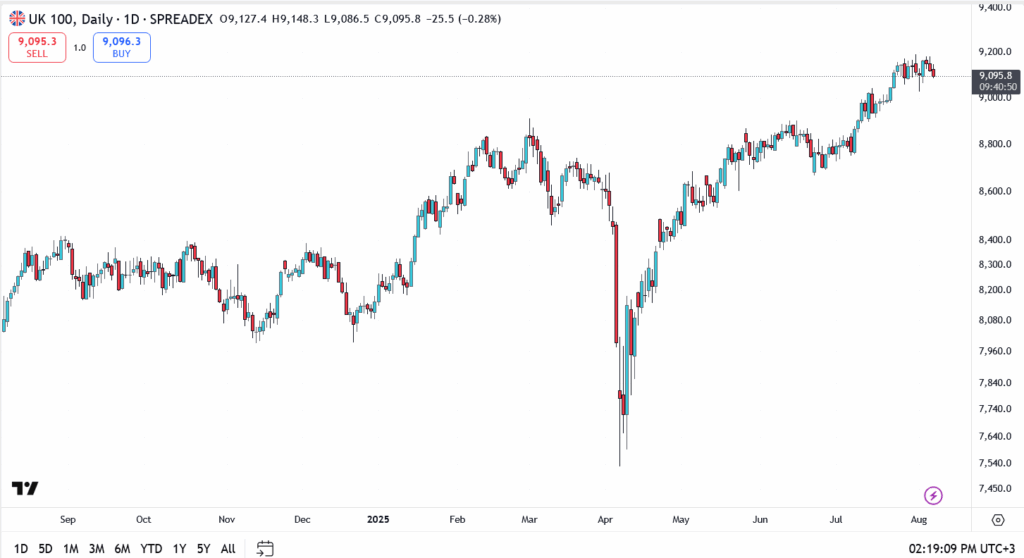

The FTSE 100 gave up ground on Thursday afternoon, slipping 0.28% to 9,095.8 as traders digested the Bank of England’s widely expected rate cut. The central bank trimmed rates to 4%, but a cautious tone in the statement clipped risk appetite, especially with the index perched just below all-time highs.

This was a textbook case of “sell the news.” After surging more than 9% over the past three months, the FTSE’s rally had started to stall near the 9,200 zone, a level that’s acted as a psychological ceiling for the past few sessions. The mild pullback doesn’t break trend, but it does flag some hesitation as investors weigh the next catalyst.

Sector Snapshot: Healthcare and Defence Drag

Healthcare names led the decline, with Hikma Pharmaceuticals plunging over 6% after trimming margin guidance for the rest of the year. BAE Systems and Rolls-Royce also lost ground, as global defence names slipped across Europe.

The broader tone was mixed. Rate-sensitive stocks like Lloyds and Barclays barely moved, while housebuilders posted minor gains as lower rates rekindled hopes for a housing uptick. Energy stocks tracked sideways, caught between weak oil prices and hopes of stabilising Chinese demand.

FTSE 100 Technical Levels:

- Current price: 9,095.8

- Immediate resistance: 9,200 (recent highs)

- Support: 8,950, then 8,775

The index is still hugging its rising trendline from the April breakout. A close above 9,200 would clear the way for a fresh leg higher, likely targeting 9,350. But if 8,950 breaks, the correction could deepen into the 8,775–8,800 zone. So far, dip buyers are showing up near every soft patch, but the conviction is clearly thinning.

Outlook: Cooling, Not Cracking

This isn’t a sell-off, it’s a breather. The FTSE’s run has been relentless since Q2 began, and even with Thursday’s dip, it remains one of the world’s best-performing large-cap indices this year. But after pricing in multiple BoE cuts and soft UK inflation prints, the next driver may have to come from earnings or external macro surprises.

Until then, markets look poised for choppy range trading. Bullish structure intact, just no longer bulletproof.