Tuesday saw Wall Street soar higher as growing expectations on a September rate decrease drove the Dow, S&P 500, and Nasdaq all further into bullish territory. The rotation into tech, financial, and consumer companies helped the Nasdaq set fresh weekly highs, while the Dow surged more than 580 points to close above 44,170.

Bets that the Fed is finally getting ready to change course have been rekindled by dovish remarks from senior Fed officials and soft economic data. With bond yields dropping and equities inflows quickening in anticipation, traders now perceive a growing likelihood of a cut by the next policy meeting.

Large-cap tech led the charge, but industrials, financials, and consumer discretionary sectors also saw solid bids, suggesting that the rally is broadening. Analysts at Morgan Stanley and Goldman Sachs now see room for major indices to retest or surpass their all-time highs in Q3 if inflation continues to cool and macro indicators stabilize.

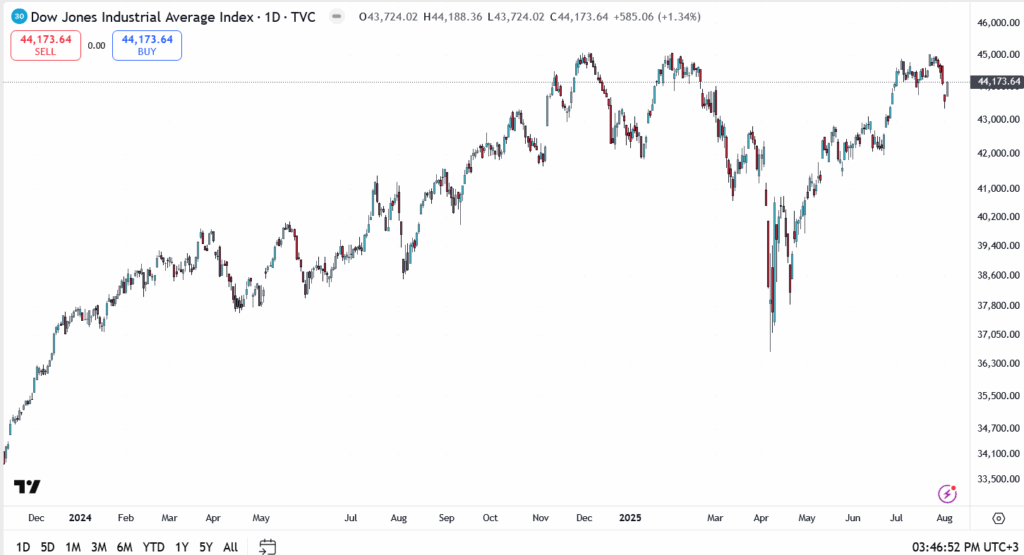

Dow Jones Chart Analysis

- Current level: 44,173.64

- Next resistance: 44,600, then 45,000

- Support: 43,250, then 42,800

The Dow has cleared near-term resistance after bouncing off 43,000 last week. A daily close above 44,600 could open the door for a run toward 45,000, a level last seen before the June correction. If momentum stalls, bulls will look to defend 43,250, which acted as a springboard earlier this month.

Conclusion

Wall Street’s optimism is back, and this time, it’s riding on more than hope. With the Fed shifting its tone, corporate earnings beating expectations, and inflation metrics softening, the stage is set for a potential breakout across all three major indices.

Whether or not record highs are hit this week, the bulls clearly have the upper hand. The only question now is whether the momentum carries into the Jackson Hole summit later this month.