Geopolitical tensions are back in the spotlight, and Wall Street is starting the week on edge. Over the weekend, President Donald Trump confirmed that the U.S. had carried out airstrikes on Iranian military targets, a clear escalation in an already fragile Middle East. Investors around the world are watching closely, unsure whether this marks the start of a wider conflict or just another flare-up in a region that rarely stays quiet for long.

The Dow Jones Industrial Average is holding steady near 42,200, showing no signs of panic, yet. Traders are cautiously positioning ahead of Monday’s U.S. session, with oil prices rising, gold catching a bid, and safe-haven flows gaining traction.

What’s Driving Market Mood Today

Markets are being pulled in two directions. On one side, geopolitical tensions are ramping up after President Trump confirmed U.S. airstrikes on Iran, raising the stakes across the Middle East. Oil prices jumped more than 2% as supply fears returned, and investors quickly rotated into safe-haven assets like gold and government bonds.

On the other side, the Federal Reserve isn’t offering much relief. Chair Jerome Powell doubled down last week on the Fed’s data-dependent stance, saying there’s no rush to cut rates. With inflation still sticky and growth holding up, the central bank looks content to wait, and that’s keeping a lid on any real upside for now.

Dow Jones Chart Analysis Today

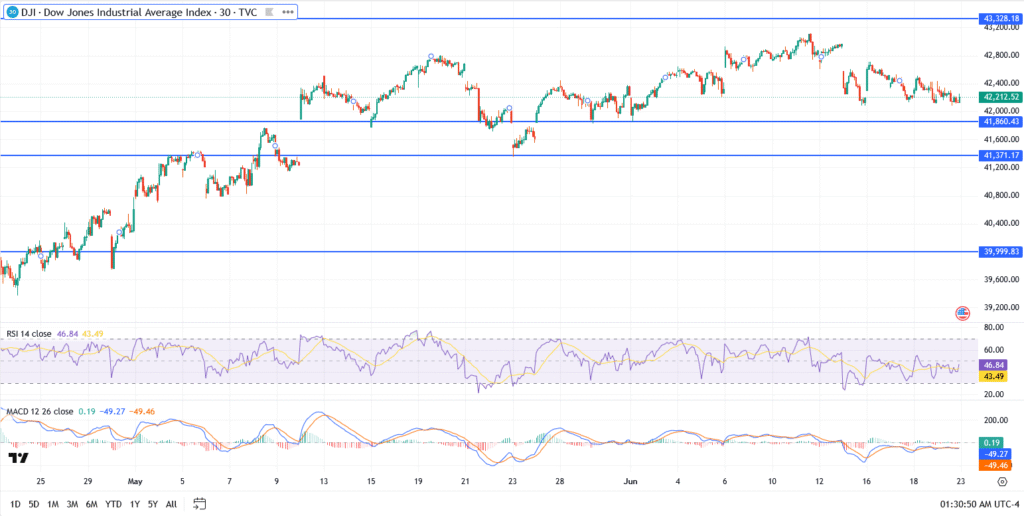

- Current price: 42,212

- Resistance: 42,800 and 43,328

- Support: 41,860, then 41,371

Dow Jones Industrial Average Outlook

Tensions in the Middle East are heating up again, with Israeli airstrikes and Iranian missile launches fueling fresh fears of a wider regional conflict. That uncertainty, combined with a Federal Reserve that’s still in wait-and-see mode, has left traders cautious.

The Dow Jones Industrial Average is moving sideways, caught between rising war risk and a central bank that isn’t offering much clarity. With oil prices ticking higher and no clear resolution on the table, markets could break out of this tight range fast especially once U.S. traders fully process the weekend’s developments.