- IAG share prices are up by almost a percentage point in today's trading session. The bullish move is a continuation of a long-term trend

IAG share prices are up by almost a percentage point in today’s trading session. The bullish move is a continuation of a long-term trend that started on March 7, 2022, that has seen the prices rise by 37 per cent.

IAG has struggled in the past few years due to the pandemic and the halting of planes on some of its routes due to recent political uncertainty involving Russia and Ukraine. However, a recent analysis showed a slight improvement in the company from the 2020 financial year. In a report released in March for the financial year ending the same month, the company had a loss of €2.97 billion ($3.22 billion).

The loss, though significant, was a huge improvement from the previous pandemic year. The analysis also highlighted the company performed exemplary well compared to other airlines. It also created optimism, with the group expecting strong profitability in the current financial year.

On finances, the report indicated that the company had good liquidity. However, during the pandemic, they had been forced to take loans that needs to be paid. The ability to pay is likely to impact the markets and result in either a bullish or bearish trend. The company also has to finance a substantial new aircraft order book. This will replace some of its fleets that were retired, including the Boeing 747s.

IAG Share Price Prediction

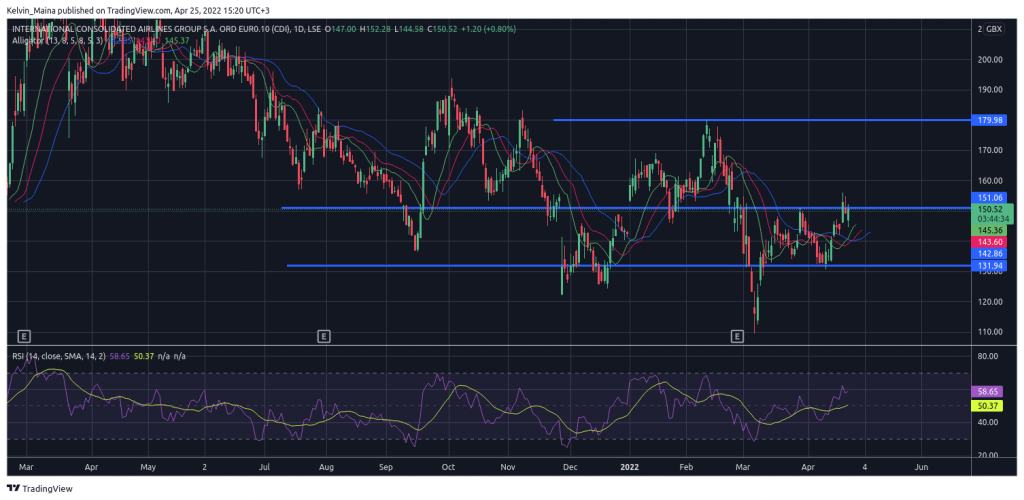

IAG’s share price recently passed the 150p price level but failed to break strongly to the upside. Since then, the prices have traded sideways. However, today’s trading session is showing signs of a strong bullish move likely to result in prices setting new monthly price highs. In addition, both the Williams Alligator and the RSI indicators are also showing signs of a strong bullish move.

Therefore, I expect the current bullish trend shown on the chart below to continue. There is a high likelihood of the prices trading above the 180p resistance level. However, if the prices fall below the 150p level, my bullish analysis will likely be invalidated. It will also mean a possible retest of the 131p support level.

IAG Daily Chart