- A look at the HSBC share price for 2022, 2025 and 2030 plus the company's finances and recent headlines that are likely to impact its future.

In this article, we will look at the HSBC share price for 2022, 2025, and 2030. We will also focus on the company’s finances and recent headlines that are likely to impact its future.

HSBC Company Profile

The Hongkong and Shanghai Banking Corporation Limited (HSBC) has more than 150 years of rich history. The banking institution opened its doors in Hong Kon on March 3 1865, and a month later, it opened its Shanghai branch.

HSCNB was founded by Thomas Sutherland, a young Scottish businessman working in Hong Kong for a large shipping firm. However, Sutherland did not have a bank account when he got the inspiration after reading an article on Scottish banking. He would later use his connections to get the backing of 14 of the biggest firms operating in Hong Kong. As a result, the institution raised HKD5 million after selling 20000 shares at HKD250 each, marking the beginning of the more than 150 years of HSBC operations.

HSBC Financial Reports

HSBC is one of the largest financial institutions in the world. Today, the banking institution boasts of having total equity of over $200 billion and assets worth $2.98 trillion as of December 2021. The company also has $10.8 trillion under custody, as of the latest 2021 data and $4.9 trillion in assets under administration (AUA).

In the financial year 2021, the company was able to post impressive numbers. This includes the revenue made for that year which totaled £52.83 billion. This was a significant decline from the revenue the company had posted in 2020 which totaled £60.56 billion. In 2021, the company also posted a profit of £9.17 billion, an almost a threefold increase from the profits it had made in 2020 of £3.11 billion. The company’s 2021 financial reports also shed light on its financial standing including its debt to asset ratio, which currently stands at 93.77 percent.

HSBC Fundamental Analysis

Recent news cycles and decisions being made by HSBC are likely to impact its long-term growth and future. This includes the latest reports that HSBC planned to close more than 69 of its branches. This comes amidst the lifting of covid-19 restrictions across the UK. According to the company, the plan to close the branches comes amidst people increasingly preferring mobile and online services than visiting a physical bank. According to the bank, the decision is part of its effort to reshape its network in response to online and banking preferences. Last year, the company closed 82 branches across the UK, dropping the number of bank branches from 593 yearly last year to the current 441 branches.

Another recent decision by the bank is acquiring a virtual plot of land in an online gaming platform called the sandbox. Although a bit odd for an investment bank, this investment will help the company adapt early to the current digital push. It will also help HSBC get into sports, e-sports and gaming platforms and connect with clients on these platforms. With the recent development of web3, the investment in blockchain technology also shows the bank is prepared for future changes in technology.

HSBC Share Price 2022

In 2021, HSBC’s share price rose by 17 percent. Today, the share price stands at 9 percent above its year’s opening price and is currently trading at GBp 500. The HSBC share price has also recently started a bullish move, increasing 11 percent since March 07.

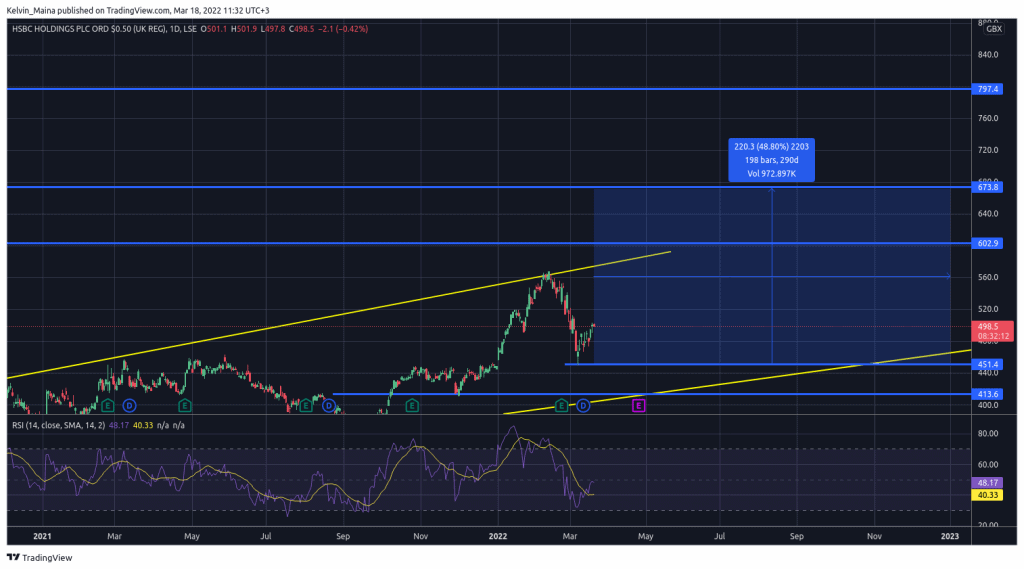

In the HSBC daily chart below, my HSBC share price prediction is highlighted by the region marked blue. I expect the share prices to trade within the region, and by the end of the year, the prices to trade at around the GBp 673 resistance level. This is because, looking at the chart, the prices have been trading for a long time within the support and resistance levels of GBp 413 and GBp 673 respectively. The prices have also recently hit the support level and failed to break to the downside. The current bullish push also looks more like a trend reversal. therefore, I expect the prices to continue pushing upward, and by year’s end, I expect the prices to trade 35 percent above current prices.

HSBC Daily Chart

HSBC Share Price 2025

There is a high likelihood that by 2025, the prices of HSBC will be trading above GBp 1,000. This is because the banking institution will still be one of the largest financial institutions in the world. The fundamental analysis described above will also have a great impact by 2025 and will push the prices of the shares up.

If the prices of stock will have risen to GBp 1000 by 2025, it will mean that the average annual growth rate between 2023 and 2025 will be 21 percent. This is close to what the HSBC share price rose by in 2021.

HSBC Share Price 2030

In 2030, I expect the HSBC share price to be trading at 2,500 GBp. I expect the annual growth rate between 2025 and 2030 to be between 17 to 25 percent per year. This is a realistic annual return on investment based on the historical price action of the company’s share price.

Is HSBC a Good Investment?

HSBC is a good investment because it is backed by a strong history and consistent returns over 150 years of history. Therefore, investors looking for a more stable investment opportunity should look at HSBC, which is less risky with minimal chances of going bankrupt by 2030.