- Hedera Hashgraph price prediction as it struggles below $0.2000. What are the prospects heading into the weekend?

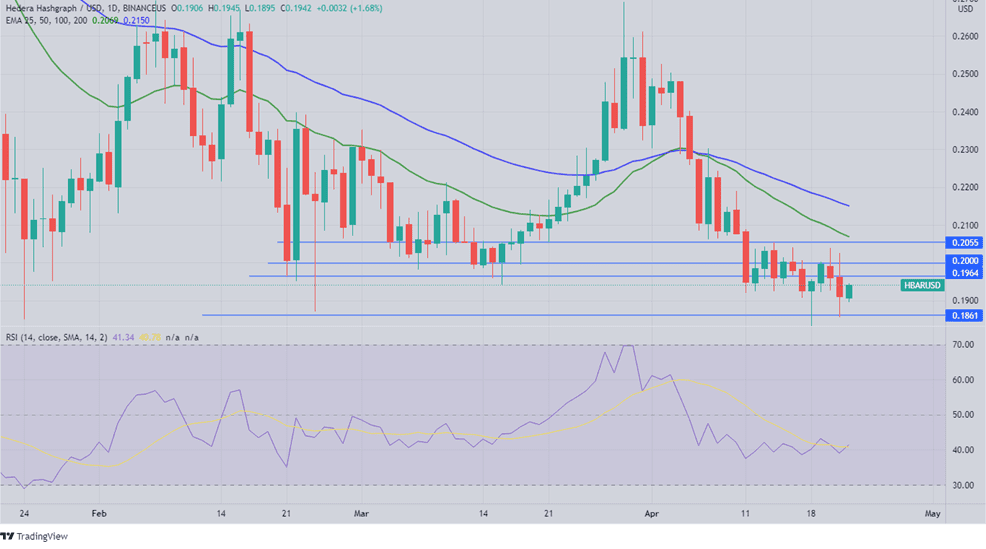

Hedera Hashgraph price has been trading in a tight range between $0.190 and $0.205 over the past week. In the absence of strong price momentum, HBAR price is sending mixed signals, and investors will likely be looking for a near-term breakout. HBAR has lost about 14.1% of its value in the past two weeks, and a return above $0.220 could signal a reversal.

HBAR price and market fundamentals

The Hedera Hashgraph network has positioned itself as an alternative to Ethereum and other POS networks, thanks to its fast transaction speeds, low user fees and high energy efficiency. However, it has struggled to live up to expectations despite its proven abilities.

Consequently, the platform is on a mission to increase its user base by strengthening its smart contracts and DeFi segments. Also, in March, it announced that it had set aside $155 million to drive DeFi development on the network. It hopes to use the liquidity to build a strong staking and lending infrastructure with attractive features to attract more users.

Also, the HBAR Foundation announced yesterday that it had established a Privacy Market Development Fund, which will support the creation of privacy-focused solutions on the network’s Web3 ecosystem. This is likely to attract retail users and institutions keen on preserving their privacy. However, this is unlikely to impact the network’s user numbers immediately. Generally, the HBAR network has a strong foundation for a takeoff, but it is yet to find the spark that will ignite the fuel for such an action.

Hedera Hashgraph price prediction

HBAR’s price momentum is largely neutral, with the RSI at 40. Also, the RSI has formed an uptick and is just about to cross above the 14 SMA. These factors signal that the price could remain above the support at $0.1861. With the support at this level, R1 is likely to be at $0.1964 and R2 at $0.2000. Additionally, a reversal could be in play if the price hits $0.2055. However, this bullish view will be invalid if the price breaches the $0.1861 support.