- The Google share price slumped on Wednesday after the company's earnings missed estimates and warnings of a tough Q2 2022 ahead.

The Google share price slumped on Wednesday after the company’s first-quarter earnings missed market expectations. Even though the continued recovery in travel boosted its Google Search and other advertising revenues by 24% on an annualized basis, revenue for YouTube slumped year-on-year from the 4th quarter numbers. YouTube revenue grew 14% to $6.9billion, but this was lower than the 4th quarter annualized jump of 25% on increasing competition from TikTok and other short video platforms.

Total revenue for the parent company Alphabet rose 23% to $68.01 billion in the first quarter, which beat the market expectations of $67.9 billion. However, earnings per share slowed from $26.29 a year ago to $24.62 in the first quarter. This figure also lagged the consensus estimate of $25.78. This was due to a rise in operating costs, which topped $18.3 billion and represented a 24% rise.

The forward guidance provided by Chief Financial Officer Ruth Porat was sobering. She indicated a “particularly tough comp” in Q2 2022, even as the company’s suspension of commercial activities in Russia also comes to bear. She also said that a decline in revenue from Google Play offset the growth seen in YouTube subscription sales due to previously announced fee-related changes.

The company has received clearance to repurchase $70billion worth of its Class A and Class C shares, following on from $52billion worth of similar purchases that have been ongoing. The Google share price slumped on market open, gapping downwards to register a 3.43% slide, even though it is off session lows.

Google Share Price Outlook

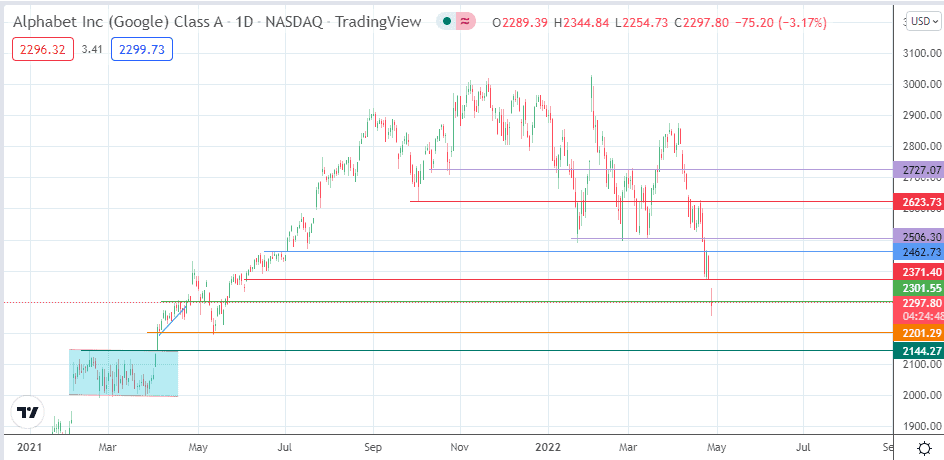

The intraday slump has put the closing price below the 2301.55 support. The daily candle needs a 3% penetration close below this support to confirm the breakdown. This scenario will open the door for the bears to chase down 2201.29, a low last seen on 21 May 2021. Below this support, additional downside targets are found at 2144.27 (5 April 2021 low) and at the rectangle’s lower border, covering lows of 23 February to 29 March 2021.

On the flip side, the bulls need to sustain a close above 2301.55, and follow this up with a bounce that aims for the 2371.40 resistance (4 June 2021/26 April 2022 lows). Above this level, additional barriers exist at 2462.73 (2 July 2021 low) and at 2506.30 (21 January and 14 March lows). 2623.73 (20 April high) only becomes available if the previous targets are exceeded.

Alphabet (Google): Daily Chart