- Glencore share price has consolidated from a recent high near 400p in October as the market weighs the prospects for commodities.

Glencore share price has consolidated from a recent high near 400p in October as the market weighs the prospects for commodities.

A rival energy trading firm has been talking about the potential for a tough winter for European energy and also for $100 oil in the medium-term. Jeremy Weir, CEO of Trafigura, was talking at an FT summit in Asia and he discussed energy, oil and commodities.

“We haven’t got enough gas at the moment quite frankly, we’re not storing for the winter period. So hence there’s a real concern that there’s a potential if we have a cold winter that we could have rolling blackouts in Europe”.

The higher price of natural gas has also boosted demand for oil with Brent crude up 60% since the start of the year, trading above $80 a barrel.

“We are seeing a very, very tight oil market,” Weir said.

Climate change has put companies under pressure to ditch fossil fuels and that has seen a drop in investment.

“I think people need to recognise it’s not a situation where you might just flick the switch and you increase production. There’s a lot of investment, it takes some time to do that,” said Weir.

“I think we have got a bit of an issue looming on oil prices on a long-term basis, I think $100 plus on oil … (is) very possible.”

Weir also warned about significant deficits for cobalt, nickel and copper as demand rises for electric vehicle batteries and renewable energy.

“Some of these metals are just not going to be available due to the increase in demand,” he said.

“We’ve already seen a significant increase in demand not just from China but also from the U.S. and from Europe and we expect to see significant deficits in some commodities.”

On copper he said:

“Once we get through possibly Chinese New Year into the end of Q1 of next year … Unless we see a major meltdown in industrial production out of China, I think we got a pretty critical situation with respect to copper prices.”

The comments from the Trafigura CEO are highlighting supply issues across the board in commodities and this will support the share price of Glencore. Inflation is also higher with the UK and Europe both showing a 4% y-o-y figure and the US above 6%.

Glencore price Analysis

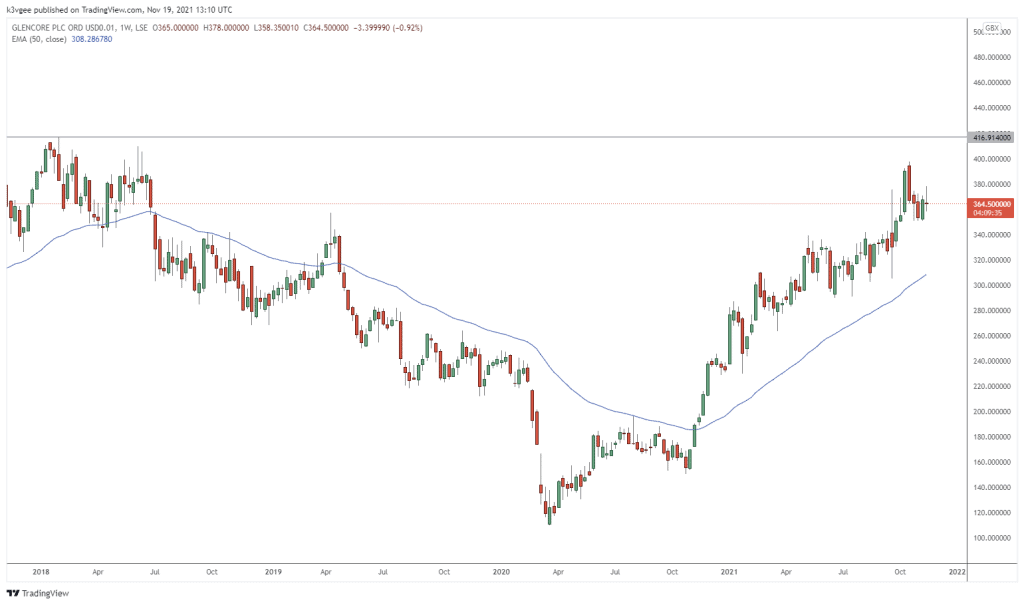

The price of Glencore bottomed with the commodity lows in March 2020 and has been on an uptrend since then due to the recovery in mining and oil. The market’s realisation of higher inflation has fueled that run further. The price of Glencore is now 364p and the next key resistance level would be 417p which was the high in 2018. Initial support for a pullback comes in ahead of 300p.

Glencore Price Chart (Weekly)