- Glencore share price has been in a tight range in the past few days. The stock is trading at 354p, which is about 12% below its all-time high.

The Glencore share price has been in a tight range in the past few days. The stock is trading at 354p, which is about 12% below its all-time high. Still, the GLEN share price is about 25% above where it started the year at.

What next for GLEN shares?

Glencore is one of the biggest mining and trading companies listed in the London Stock Exchange (LSE). The company has a long and storeyed past. It was started by Marc Rich, a fugitive who was pardoned by President Bill Clinton.

Glencore operates in three key businesses. It operates in the metals and minerals, energy, and marketing business. The marketing business is a moniker for its trading operations, which is its most important business lines.

As a commodity trader, Glencore buys, stores, and transports various commodities every day. For example, the company trades in millions of barrels of oil every day. It also buys and sells metals and other commodities globally.

Glencore has made billions of dollars during the pandemic. Like other traders like Vitol and Trafigura, the company bought millions of barrels of crude oil when their prices fell. It then took advantage of the rising prices and made a killing.

This year, the company has benefited from the rising coal prices. Coal has surged globally because of the low investments in the industry as woke mining companies dump the sector. Also, Glencore has benefited from the rising prices of other metals.

As such, analysts expect that the Glencore share price will keep doing good in the near term. Besides, the company will likely boost its dividends and share buybacks.

Glencore share price forecast

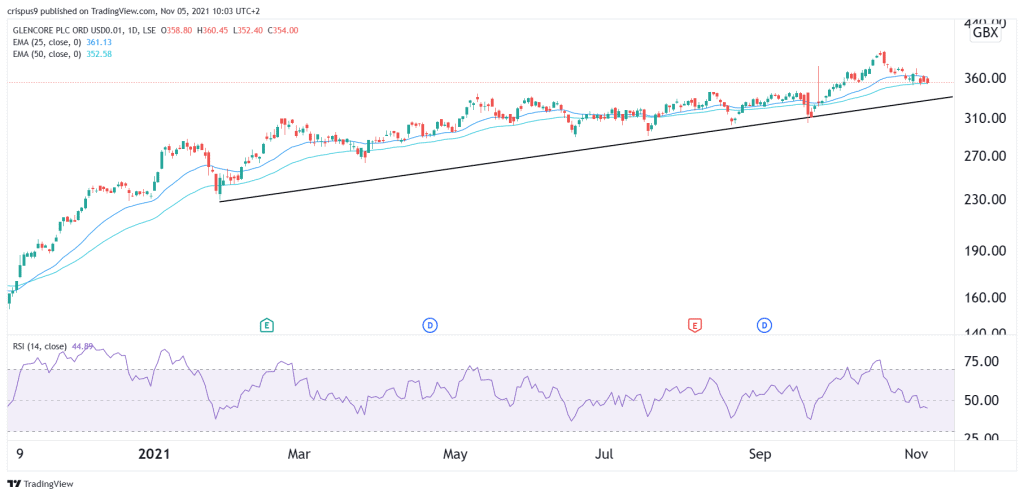

The daily chart shows that the Glencore share price has been in a strong bullish trend lately. However, its price has struggled in the past few days. This trend is because the strong commodities rally has stalled. Also, investors believe that the benefits of the upcoming dividends have already been priced in.

Still, the price is along the 25-day and 50-day moving averages. It has also moved above the ascending trendline that is shown in black.

Therefore, while a pullback is likely to continue, the bullish trend will likely keep going as long as the price is above the rising trendline.