- Advance of the Glencore share price has stalled after environmental assessment shows that $1,5bn Valeria mine threatens endangered species.

The Glencore share price is slightly lower on the day, which threatens to halt a three-day advance. This follows investor response to the concerns that have emerged over the company’s proposed $1.5billion coal mine in Queensland, Australia.

Glencore had committed to a 2050 zero-carbon emission plan and insisted that the new mine fit into those plans. However, environmental concerns have emerged after the company submitted a list of endangered species threatened by the coal mine’s development. Environmentalists say the mine will destroy farmland and habitats for these species.

The Valeria mine is expected to produce 16m tonnes of coal a year and has a projected life span of three decades, perhaps informing Glencore’s 2050 net-zero-carbon deadline.

Glencore Share Price Outlook

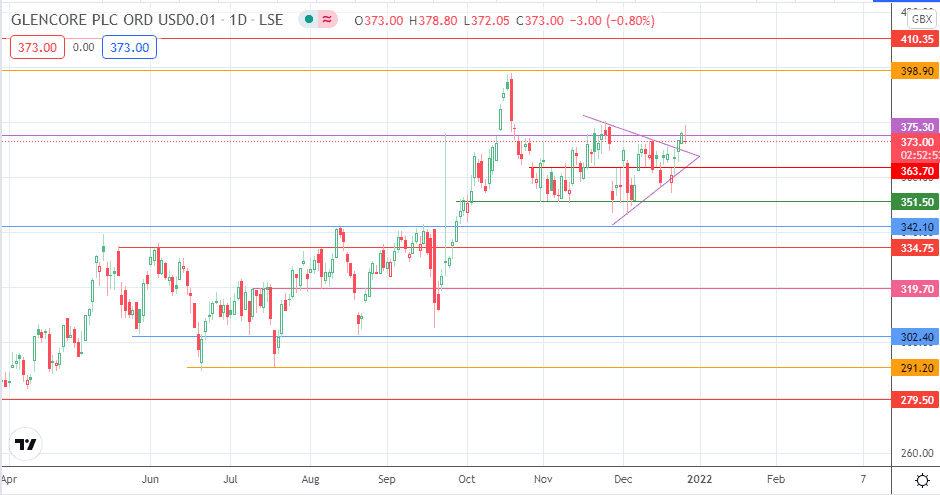

The break of the triangle to the upside has stalled at the 375.30 resistance. The bulls must uncap this level for the breakout move to continue, advancing the price action towards the 14 May 2018/19 October 2021 highs at 398.90.

On the other hand, forming a pinbar candle with a close just below the 375.30 resistance could indicate the potential for a reversal, which would target 351.50. Intervening support is seen at 363.70 (30 November/21 December highs). Additional downside targets are seen at 342.10 and 319.70, but these only become available if there is a steep correction below 351.50.

Glencore: Daily Chart

Follow Eno on Twitter.