- GBPUSD held on to most of its gains yesterday despite pessimistic remarks from BOE Governor Mark Carney. It even looks poised to rally above 1.3000.

GBPUSD finished yesterday’s trading higher despite pessimistic remarks from BOE Governor Mark Carney. The currency pair closed higher at 1.2951 from its opening price of 1.2914.

In his testimony before the House of Lords Economic Affairs Committee, the outgoing BOE Governor expressed his concerns about the coronavirus outbreak. He said that the disease already poses more adverse effects to the economy than SARS did in 2003. Additionally, he said that the British economy could be provided with additional stimulus to push growth to the bank’s target level despite the risk of higher inflation.

His remarks were in contrast to that of other central bankers like Fed Reserve Chairman Powell and the RBNZ. However, despite his pessimism, GBPUSD was able to hold on to its gains brought about by the GDP report. Yesterday, the UK’s monthly GDP printed at 0.3% versus the 0.2% forecast. This was enough to fuel a rally in GBPUSD despite the reading for Q4 2019 coming in (as expected) at 0.0%.

Read our Best Trading Ideas for 2020.

GBPUSD Outlook

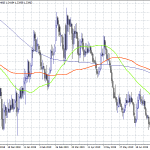

On the hourly time frame, we can see that GBPUSD is trading above the neckline resistance of the inverse head and shoulders pattern I pointed out yesterday. It is not uncommon for the market to trade lower after a neckline-break. If buyers are not able to sustain their momentum above 1.2960, we could see GBPUSD fall to support at 1.2930. If it does not hold, it could drop lower to Monday’s low around 1.2870.

On the other hand, it is also worth-pointing out that a bullish pennant chart pattern has formed on GBPUSD. This is considered as a bullish continuation pattern and a break above the consolidation around 1.2970 could trigger a bigger rally. The currency pair may soon trade higher to 1.3070 and test its February 5 highs.