- GBPUSD was little changed as the previous weeks' rally hit brakes. Investors are concerned about Brexit and excited about the US jobs data

The GBPUSD pair was little changed today as investors digest the impressive jobs data from the United States. They are also focusing on Brexit and the new strategy by Boris Johnson to boost the economy.

Boris Johnson set to improve his ratings

In recent weeks, Boris Johnson’s polls have taken a beating due to his response to the coronavirus crisis. According to Worldometer, the UK has the most deaths in the world after the United States. It also has the most infections after the US, Brazil, Russia, and Spain.

Analysts have blamed this to Johnson’s slow pace of response. As a result, most polls show that his support has been falling. A poll by Opinium showed that only 47% of UK adults support the premier while another one by Survation an Deltapoll showed similar results.

Now, he is working to improve these numbers. According to Bloomberg, he plans to ease the lockdown, and announce measures to boost the economy. These includes increasing funding for the NHS, roads, and research.

GBPUSD rally halted

The GBPUSD pair rally has paused as investors continue to price-in the risks posed by Brexit and the deteroriation of the economy. Just today, British Petroleum (BP) said that it would slash about 10% of its workforce, which will have significant impacts on the economy. This is happening a few days after UK and the UK failed to agree on anything with the EU.

Also, it is happening at a time when most speculators are short the pound. According to the CFTC, net shorts on the pound have increased to the highest level this year.

Download our Q2 Market Global Market Outlook

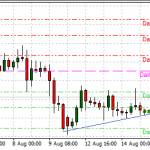

GBP/USD technical outlook

The GBPUSD pair is trading at 1.2675, which is close to its highest level since March 12. On the daily chart, the price is above the 50-day and 100-day exponential moving averages. It is also slightly below the 61.8% Fibonacci retracement level. Also, the price has moved above the previous resistance level of 1.2643 and possibly invalidated the cup and handle pattern. This means that the price will likely continue moving upwards as bulls attempt to test the 61.8% retracement at 1.2725.

On the flip side, a move below the 50% retracement at 1.2474 will invalidate this prediction because it will sends a signal that there are more sellers in the market.