- GBPUSD is adding 0.17% at 1.3025 after better than expected UK employment data. UK Claimant Count Rate dropped to 3.4% in January from the previous 3.5%.

GBPUSD is adding 0.17% at 1.3025 after better than expected UK employment data. UK Claimant Count Rate dropped to 3.4% in January from the previous 3.5%. The Unemployment Rate for December came in at 3.8% in line with consensus. The UK Average Earnings Excluding Bonus came in at 3.2%, below the forecasts of 3.3% in December. The report shows that employment (76.5%) is at a record high while the unemployment rate holding close to 45 years low. The UK employment market provides a robust foundation for economic recovery.

Hard stance rhetoric from UK negotiator David Frost holds at a high level the risk of a hard Brexit. Frost said that the UK would not be threatened into following the EU rules and will trade with the EU on basic international terms.

Read our Best Trading Ideas for 2020.

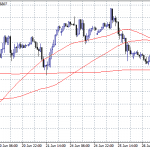

GBPUSD Technical Outlook

GBPUSD is higher today boosted by the positive data. The outlook is neutral as the pair is trapped between the 50 and 100-day moving average. GBPUSD formed a double top at 1.3070 the last two weeks and only a break above might initiate another leg higher.

On the upside, the immediate hurdle stands at 1.3048 the daily high. If the pair break above the daily top more offers would be met at 1.3066 the 50-day MA and then at 1.3070 the February double top. A break above that level would target the next hurdle at 1.3183 the high from February 3.

On the other side, the initial support for the GBPUSD stands at 1.2971 the daily low. Next support will be met at 1.2943 the low from February 13. The 100-day moving average at 1.2926 would be the next critical support. A break below would attract more bears to join the action targeting the 1.2871 February low.