- GBPUSD continues south for the second day after PM Boris Johnson is expected to propose general election by December 12th to break Brexit deadlock

GBPUSD continues south for the second day after PM Boris Johnson is expected to propose general election by December 12th to break Brexit deadlock. European Union officials said they wanted more clarification from United Kingdom before agreeing on extension. Mixed headlines crossing the wires around the Brexit deal increases Pound volatility. In US Durable goods orders fell more than expected in September while shipments also declined, in a warning sign that business investment remains weak.

Download our GPUSD Q4 Outlook Today!

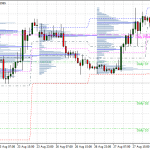

[vc_single_image image=”14654″ img_size=”medium” alignment=”center” style=”vc_box_rounded” onclick=”custom_link” img_link_target=”_blank” link=”https://www.investingcube.com/q4-global-market-outlook-eurusd-gold-crude-oil-bitcoin-sp-500/”]GBPUSD trades close to daily low, giving up 0.08% at 1.2841, while the outlook is positive for GBPUSD despite the weak morning start. On the upside where traders turned their focus now, first resistance can be found at 1.2861 the daily high, after that level next hurdle stands at 1.2949, with more offers probably emerging at the 1.3050 the high from mid-May 2019.

On the downside, the first support level for GBPUSD stands at 1.2822 the daily low and then at 1.2713 the 200-day moving average. The critical level for the short term momentum is 1.29; a convincing move above will attract more bulls, while a failure at that level might signal profit-taking.