- The GBPUSD pair is likely to continue rallying as bulls target the next support at 1.4300 according to analysts at Danske Bank.

The GBPUSD is up by more than 0.12% today as traders react to relatively strong economic data from the UK. The pair is trading at 1.2863, which is slightly below the yesterday’s high of 1.2910. And, analysts at Danske Bank believe that the pair is likely to continue rising in the coming month. Their target is 1.4300, which is a substantial premium from the current level.

Last week, the GBPUSD was an embattled pair as the eighth round of Brexit talks ended without a deal. The situation was made worse by the decision by Boris Johnson to pass an internal markets bill that intentionally breaks the law. Yesterday, the parliament passed the initial stages of the bill. Still, it will likely lead to opposition in later stages. The implication is that the UK will not be able to pass an agreement with the EU if the law stands.

Still, analysts at Danske believe that the two sides will reach a smaller deal by the end of the year. This is one reason why they are optimistic about the GBPUSD. Also, they believe that the Fed will help to devalue the dollar. They wrote:

“The second is a permanent Brexit trade deal between the EU and the UK, which we, despite the recent turmoil, still think is more likely than not (60% probability of a deal, 40% for no deal).”

The GBPUSD is also rising because of the strong jobs data from the UK. The data showed that the average earnings index with bonuses declined by just 1.0% in July. Analysts were expecting the wages to fall by more than 1.3%. Another data showed that the unemployment rate rose to 4.1% as expected.

The number of people who signed for claimants increased by 73.3k, which was better than the expected increase of 100k. Still, analysts expect that the unemployment rate will rise to more than 7% as the furlough program ends.

GBPUSD technical outlook

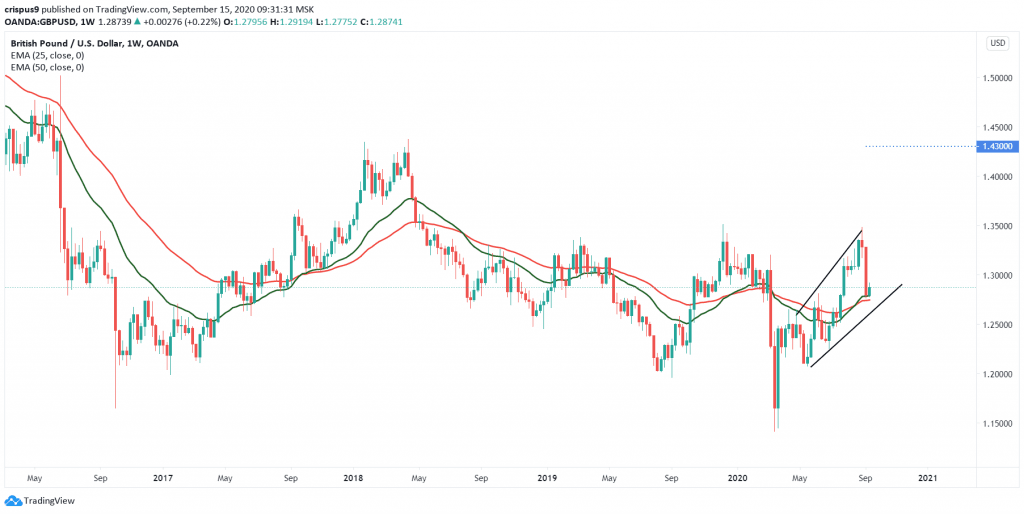

The GBPUSD pair is trading at 1.2863 while Danske analysts expect it to surge to 1.43. The weekly chart shows that the price has found strong resistance at the 50-day and 25-day exponential moving averages. It also shows that the price formed a shooting star pattern in the previous week. This pattern is usually a bearish sign. Also, the price is slightly above the ascending support that is shown in black.

Therefore, in the near term, the pair is likely to continue falling as bears target the trendline at about 1.2500. On the flip side, a move above 1.3000 will invalidate this trend.