- GBPUSD was among the biggest winners in yesterday’s trading after UK PMI reports topped expectations. Can it extend its gains today?

GBPUSD was among the biggest winners in yesterday’s trading after UK PMI reports topped expectations. The currency pair bottomed at 1.2431 in the early New York session then traded steadily higher to tap an intraday high of 1.2531. By the end of the trading day, GBPUSD had settled at 1.2518.

According to Markit, the manufacturing sector in the UK is growing. This was evidenced by the manufacturing PMI for June which printed at 50.1, higher than the 50.0 baseline for expansion. It also topped expectations which was for a reading of 45.2. Meanwhile, the services PMI for June came in higher at 47.0 than the 39.1 forecast.

It may have also helped that the UK began to ease its lockdown measures yesterday. And so, investors have gotten excited over the country’s expected growth as they unwind lockdown measures further down the road.

Today, there are no reports due from the UK. With that said, GBPUSD will likely take its cue from market sentiment. Risk appetite could push the currency pair higher while risk aversion may weigh down GBPUSD.

Download our Q2 Market Global Market Outlook

GBPUSD Outlook

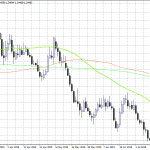

On the 4-hour time frame, it can be seen that the recent strength of GBPUSD was enough to push the currency pair above the falling trendline (from connecting the highs of June 10 and June 16. When you enroll in our free forex trading course, you will learn that a trendline break is often seen as a sign that there may be enough buyers in the market. If this turns out to be true, we could soon see GBPUSD rally to its June 16 highs at 1.2686.

On the other hand, it’s worth pointing out that on the 1-hour time frame, the currency pair has formed a rising wedge. Characterized by an upward-sloping consolidation, this is widely considered as a bearish reversal indicator. A close below the 200 SMA at 1.2505 could mean that sellers are dominating trading and that GBPUSD cold soon fall to yesterday’s lows at 1.2431.