- GBPUSD is under selling pressure after disappointment from the UK services PMI. The United Kingdom Services PMI came in at 53.2 below forecasts of 53.3 in

GBPUSD is under selling pressure after disappointment from the UK services PMI. The United Kingdom Services PMI came in at 53.2 below forecasts of 53.3 in February.

United Kingdom Services PMI came in at 53.2 below the analysts’ expectations of 53.3 in February. The weak figure adds to disappointment earlier this week from the UK manufacturing PMI. The PMI came in at 51.7 below the market expectations of 51.8 in February.

Weak PMI figures push GBPUSD to lower levels, while the uncertainty due to coronavirus also weighs on the pair. Later today the release of the U.S. ADP report on private-sector and the ISM Non-Manufacturing PMI, might affect the GBPUSD price dynamics and create short-term trading opportunities.

Read our Best Trading Ideas for 2020.

GBPUSD Technical Outlook

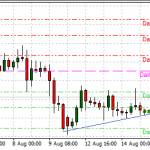

GBPUSD is 0.25% lower at 1.2783 close to daily lows after the release of weaker services PMI data. The momentum is bearish after the pair breached below the 100-day moving average.

On the downside, first support for the pair stands at 1.2771 the daily low. Next support level for GBPUSD will be met at 1.2739 the low from yesterday’s trading session. The critical support is at 1.2697 the 200-day moving average, which if breached might initiate another leg lower.

On the other side, the first resistance would be met at 1.2831 the daily high. If the GBPUSD pair breaks above, the next resistance level is at 1.2852 the high from March 2nd. More selling pressure might emerge at 1.2919 high from February 28th.