- The GBP/USD is trading higher today, but remains vulnerable from two major news releases on Wednesday and Friday.

The GBP/USD pair is up 0.24% this Tuesday, as the pair looks to build on Monday’s modest gain of 0.07%. The pair is coming off Friday’s decline brought on by the stellar US jobs numbers and the previous day’s pessimistic economic outlook by the Bank of England. Market participants appear to be trading cautiously as two key data sets that could impact the pair are due this week.

The GBP/USD will face some major tests this week. First is the highly anticipated US CPI (headline and core figures), which the market expects to have cooled as the Fed’s rate hikes kick in. However, a red-hot figure could boost market bets on more aggressive rate hikes, rendering the Pound vulnerable. Friday will see the UK GDP data released. Any data showing economic contraction in the United Kingdom could put the weak Pound further on the back foot.

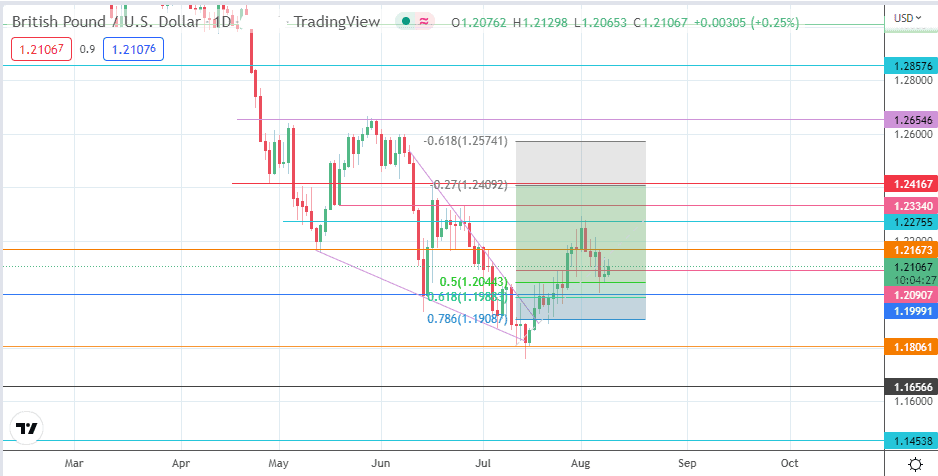

From the standpoint of technical analysis, the pair’s advance from the falling wedge’s breakout was cut short by the negative fundamentals of last week. Amid the various support and resistance levels between the 15 July low and 1 August high, various targets could be attained depending on the outcome of the news releases. These are identified in the GBP/USD forecast below.

GBP/USD Forecast

The breakout move from the falling wedge pattern met rejection at the 1.22755 resistance mark (6 May low and 28 June high). This rejection led to a retracement that bounced off the 61.8% Fibonacci retracement level and the site of the 15 June low at 1.19991.

The recovery advance needs a break of the 1.22755 recent high, a move that must also see the bulls uncap resistance barriers at 1.20907 (25/26 July highs) and 1.21673 (4 July and 5 August highs). Reaching this milestone clears the path for the bulls to aim for the 1.23340 resistance (27 June high) and 1.24167 (16 June high).

On the other hand, rejection at the current resistance mark (1.20907) and subsequent breakdown of the 5 August low at 1.19991 opens the door for the bears to push further south, targeting the 78.6% Fibonacci retracement and 21 July low at 1.19087. The 12 July low at 1.18061 forms the next downside target, with 1.16566 and 1.14538 lining up as additional harvest points for the bears.

GBP/USD Daily Chart