- The GBP/USD is set to rise to 1.3800 in the near term . This price is long the upper side of the ascending channel

The GBP/USD rally is accelerating after the Bank of England (BOE) governor shifted his tone about negative interest rates. The GBPUSD is up for the past four consecutive four-hour sessions and is trading at 1.3681.

What happened: In his previous statements, Governor Andrew Bailey has been relatively straightforward about negative interest rates. He has always insisted that the bank’s economists were doing their analysis on these subzero rates.

However, addressing the Scottish Chamber of Commerce yesterday, he warned about the complexities of such rates. For one, they would have significant implications on the UK banking sector that is extremely vital.

His statement came after a member of MPC advocated for these rates citing their success in Japan, Sweden, and the European Union. Analysts warn that the banking sector in these countries is relatively smaller than in the UK.

What next: The GBP/USD will today react to the ongoing crisis in the UK as the number of coronavirus cases continues to rise. The government is also sounding relatively hopeless considering that public debt has soared substantially in the past few months. The GBP/USD will also react to the upcoming stimulus speech in the US.

GBP/USD technical outlook

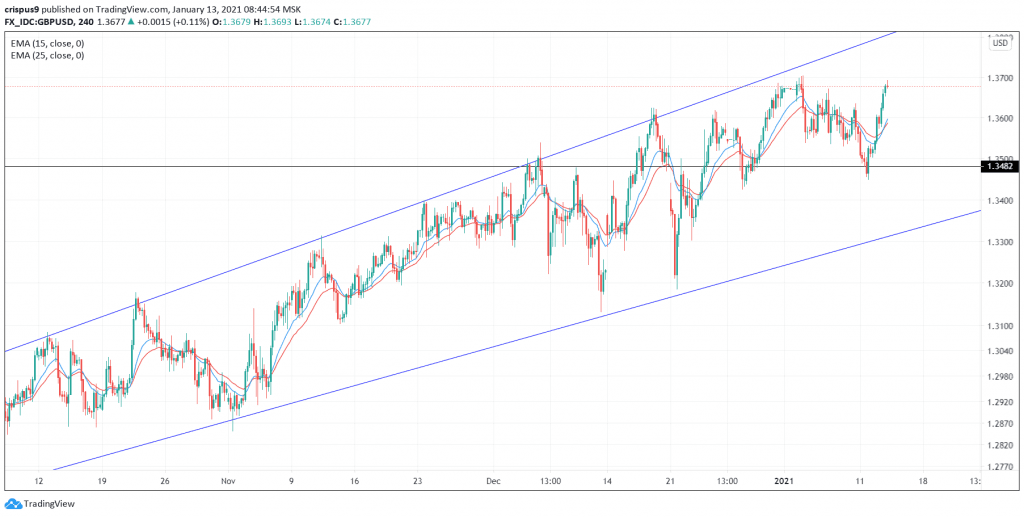

On the four-hour chart, we see that the GBP/USD is on a steady increase. The 15-period and 25-period exponential moving averages have made a bullish crossover. Also, it is between the ascending channel that’s shown in blue.

Therefore, in the near term, the pair will keep rising as bulls aim for the upper side of the channel at 1.3800. However, a decline below 1.3600 will invalidate this trend.

GBP/USD chart