- The GBP/USD pair is preparing for a bearish breakout ahead of the nonfarm payrolls (NFP) and the Halifax housing index data

The GBP/USD is under pressure ahead of the US nonfarm payrolls (NFP) and UK housing index data. The pound sterling is trading at 1.3565 against the dollar, which is slightly lower than this week’s high of 1.3702.

The background: The pound sterling has moved sideways this week as investors react to the recently-signed Brexit agreement and the lockdowns announced by Boris Johnson. While the Brexit deal was good for the currency, the lockdowns have put the country in the defensive.

That’s because many companies will continue struggling, leading to layoffs, and more government spending. This will push the public debt higher and possibly pressure the Bank of England to put interest rates to the negative zone.

What next today: Today, the GBP/USD pair will react to two vital aspects. First, it will react to the US NFP data that will come out in the afternoon session. If the numbers are good, which is unlikely, the GBP/USD will possibly fall. However, if they disappoint, it will likely drop because it will incentivise congress to provide a bigger stimulus. The GBPUSD will also react to the latest Halifax house price index data.

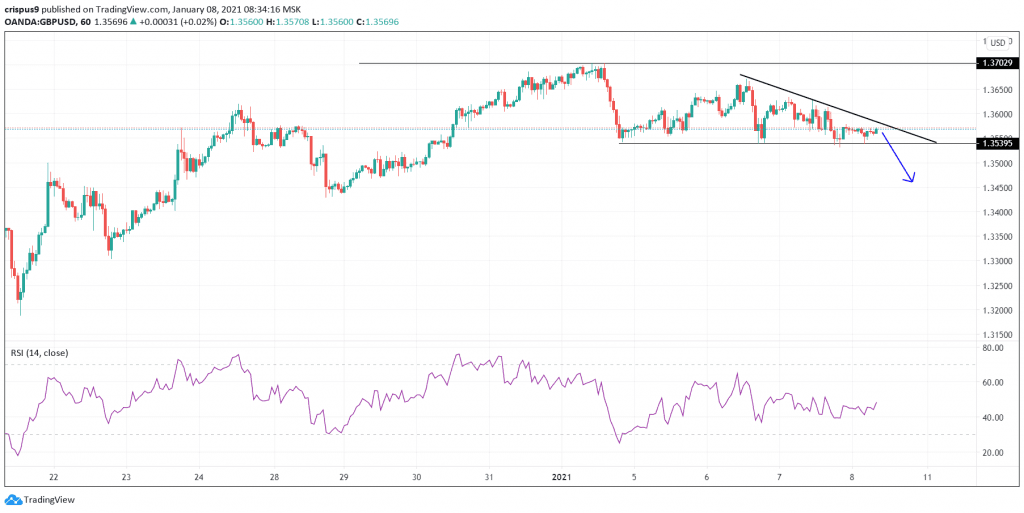

GBP/USD technical outlook

Turning to the hourly chart, we see that the GBP/USD pair is at an important juncture. It has formed a descending triangle pattern, whose support is at 1.3540. At the same time, the Relative Strength Index (RSI) is neutral.

Therefore, while the outlook is neutral, the pair will likely break-out lower because of the descending triangle pattern. If this happens, the next level to watch will be 1.3530.