- The GBP/USD price crashed to a multidecade low as investors focused on the new era of Trussonomics. GBP to USD exchange rate fell to a 1985

The GBP/USD price crashed to a multidecade low as investors focused on the new era of Trussonomics. GBP to USD exchange rate fell to a 1985 low of 1.1409 on Thursday. It has fallen by more than 17% this year as the US dollar has maintained its dominance.

Trussonomics impact on the pound

Trussonomics is a new term designed to reflect the economic view of Lizz Truss, the new Britain prime minister. Truss has vowed to cut taxes broadly and help solve the current energy crisis. The latter action will involve spending over 200 billion pounds to subsidize gas prices.

Analysts believe that the new gas subsidy will help to gradually lower inflation in the UK. However, the long-term impact of the deal will be dire considering that interest rates are surging in the UK. The Bank of England (BoE) is expected to hike interest rates by either 0.50% or 0.75% next week.

Other parts of Trussonomics are on broad tax cuts, which will also add to the overall national debt. This explains why US gilts have sold off recently. The next key catalyst for the GBP/USD pair will be the upcoming statement by Jerome Powell.

He is expected to reiterate that the Fed will continue tightening this month even as inflation eases. As a result, analysts believe the bank will hike interest rates by 0.75% this month. This view was shared by Lael Brainard, the Fed vice chair on Wednesday.

GBP/USD forecast

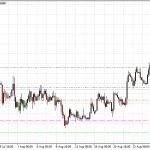

The four-hour chart shows that the GBP to USD exchange rate has been in a strong bearish trend in the past few months. In this period, the pair has managed to crash below the 25-day and 50-day moving averages. It has also dropped below the important support level at 1.1757.

Therefore, the bearish trend will likely continue as long as the pair is below the two moving averages. If this happens, the pair will likely drop below the important support at 1.1300 soon. A move above the resistance level at 1.1500 will invalidate the bearish view.