- The GBP/USD has been on an uptrend. Here are the key levels you should watch ahead of the important UK retail sales numbers

The GBP/USD is holding steady ahead of the UK retail sales numbers that will come out in the morning session. The GBPUSD pair is trading at 1.3718, which is the highest it has been since April 2018.

What’s happening: The GBP/USD has been on an upward momentum in recent days after the Bank of England (BOE) governor warned about the impact of negative interest rates. Today, focus will be on the UK retail sales numbers that will come out at 07:00 GMT.

Economists are relatively optimistic about these numbers because of the holiday season. They see the headline retail sales rising by an annualised rate of 4.0% and the core sales rising by 7.0%. Better numbers will possibly push the pound sterling pair higher.

What else: In addition to the UK retail sales data, the GBP/USD will react to the country’s public debt data and the flash manufacturing PMI numbers from Markit. In total, they see the level of public debt rising by another £27 billion. Also, they expect the services and manufacturing PMI data to be at 49.9 and 49.4, respectively.

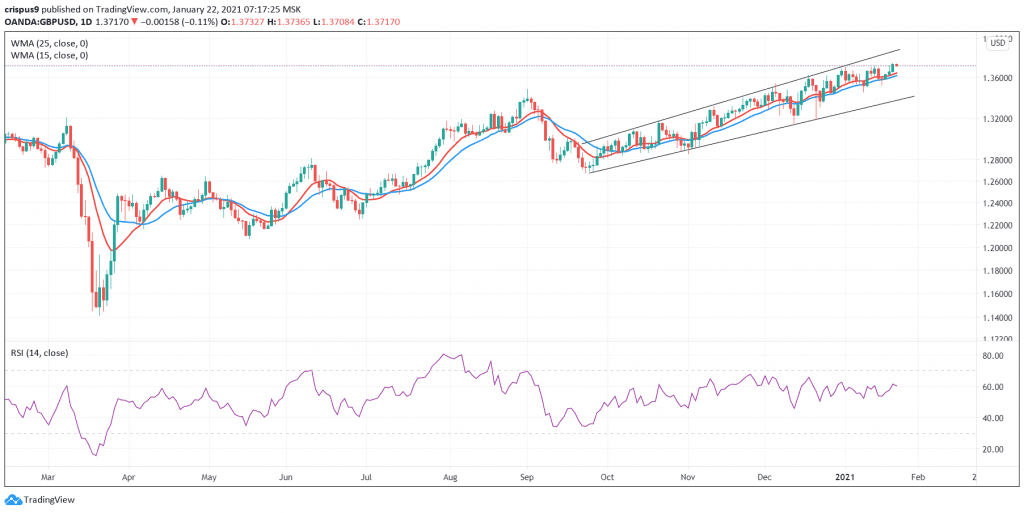

GBP/USD forecast

The daily chart shows that the pound sterling has been in an ascending channel that’s shown in black. It has also moved above the 25-day and 15-day weighted moving averages. The Relative Strength Index (RSI) and other oscillators are also at their neutral levels.

Therefore, if the UK retail sales are positive, the pair could continue rising since it will remove the urgency of negative rates. On the other hand, in case of disappointing numbers, the pair will resume the downward trend.